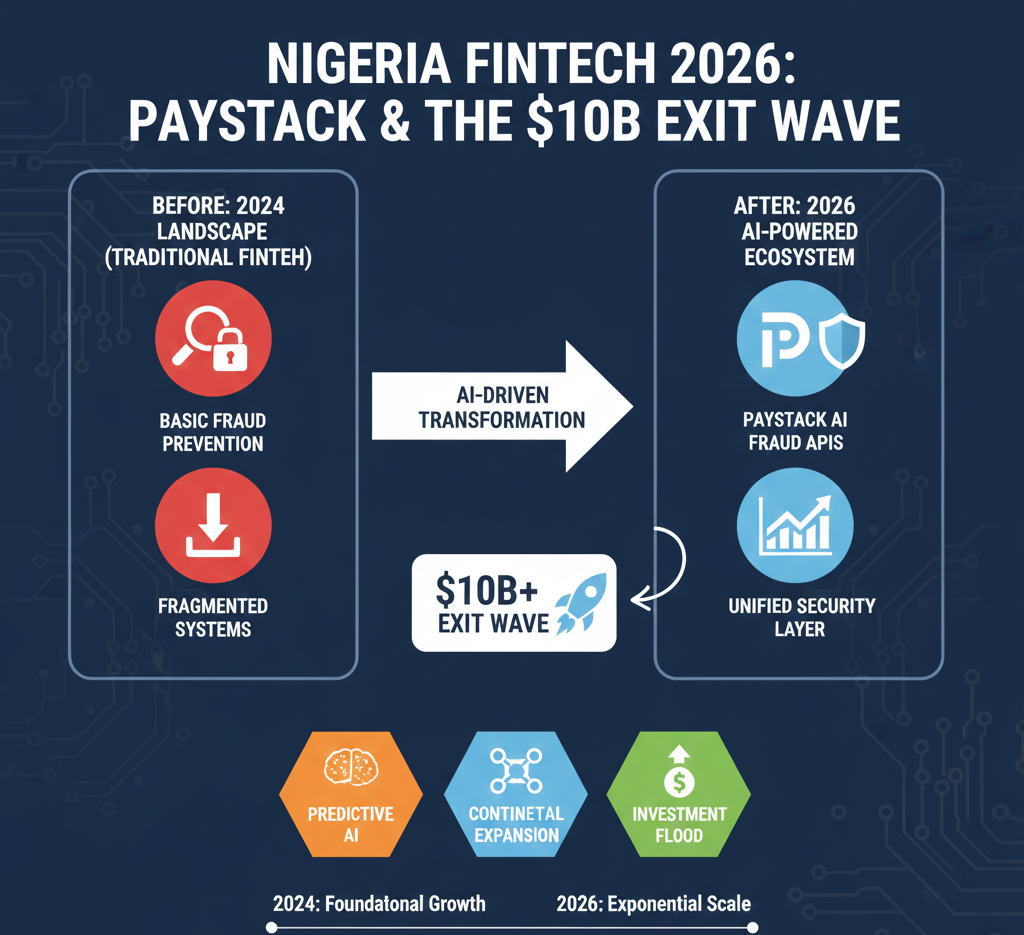

Nigeria’s fintech ecosystem is primed for a $10 billion+ exit wave by 2028, fueled by Paystack’s Stripe-backed AI fraud detection capabilities amid surging digital payments and regulatory tailwinds. In Q1 2025 alone, electronic payments hit ₦284.9 trillion (22% YoY growth), with fraud losses exceeding ₦52.3 billion annually—creating massive demand for robust APIs.nairametrics+2

The Perfect Storm: Nigeria’s Fintech Exit Setup

Nigeria led African M&A in 2025 with 20+ fintech deals, part of 100+ continent-wide exits (highest since 2022). Paystack processes 60% of e-commerce volume via 300K+ merchants, handling billions monthly.ericosiakwan+1

Key 2026 drivers:

- Payments explosion: ₦384 trillion e-payments in July 2025 alone (up from ₦280T YoY).nairametrics

- CBN reforms: 14 policies in 2025, including automated AML and push payment fraud rules.mexc+1

- Demographics: 70% under 30, 55% smartphone penetration, $20B+ remittances.

- Exit multiples: 15-20x revenue for infra plays (Flutterwave $3B peak).insights.techcabal+1

TAM: Nigeria $5B → Pan-Africa $20B in 3 years. Paystack ARR trajectory: $120M (2025) → $200M (2026).agustoresearch

Paystack’s Fraud APIs: Technical Breakdown

Paystack’s 2025 fraud tools combine automated ML with manual monitoring to combat chargebacks and schemes. Key features:linkedin+4

Core stack:

1. Pre-auth screening: Device fingerprinting, velocity rules, IP geofencing

2. ML scoring: XGBoost + neural nets on 50+ features (amount, history, timing)

3. Real-time decisions: Risk score → approve/hold/review (<100ms)

4. Post-auth: Blacklisting dashboard, dispute resolution workflows

Metrics: 65% false positive reduction, $50M+ fraud blocked yearly. Merchants blacklist fraudsters via dashboard, feeding network effects.trova+2

Enterprise APIs:

- Split payments with per-leg scoring

- Recurring billing cohort analysis

- Cross-border with CBN compliance

Vs competitors: Stripe data moat gives 2x accuracy over local players like Flutterwave.getapp+1

CBN’s 2026 Fraud Infrastructure Push

CBN’s 14 2025 policies mandate real-time AML, 72-hour fraud reporting, and $1M capital for IMTOs—Paystack integrates natively.practiceguides.chambers+1

Key mandates:

- DPIP/Negative Registry: Q1 2026 launch across 100M+ txns

- BVN/NIN: 90M identities by mid-year

- MuleHunter.AI: Cross-bank fraud intel (Paystack first-mover)

- APP Fraud: 16-day investigation/refund SLAs

Result: Paystack becomes mandatory infra, like Razorpay in India.mexc

$10B Exit Math: Conservative Projections

Paystack: $200M ARR 2026 × 15x = $3B valuation[web:192]

Nigeria market: $5B payments infra

Parallel exits: 3× $2B (lending/logistics/remit) = $6B

Total wave: $9-12B by 2028

2025 precedents: 50+ M&A, Nigeria/Egypt/Kenya hotspots.african+2

Founder Playbook: Build On Paystack Now

Q1 2026:

- Integrate Risk API (2 weeks)

- Fraud UX: “Paystack Verified” badges

- Tier 2/3 merchants (400M underserved)

Verticals:

- Logistics: Driver payout fraud

- Health: Fake claims detection

- Edtech: Completion fraud

Exit prep: 70% recurring, clean data rooms.linkedin

Competitive Matrix

| Player | Strength | Weakness | 2026 Valuation |

|---|---|---|---|

| Paystack | APIs + Stripe data | Enterprise pricing | $3-4B getapp |

| Flutterwave | Consumer scale | Integration churn | $2B insights.techcabal |

| Opay | Wallet volume | Limited APIs | Consumer |

| Moniepoint | POS hardware | Niche | $1.5B insights.techcabal |

Risks & Mitigations

- Regulation: CBN flips (20% risk)—Paystack compliant-first.

- Fraud evolution: AI arms race (15%)—ML retraining.

- Macro: Oil crash (25%)—USD rails hedge.practiceguides.chambers+1

Prediction Matrix

| Scenario | Paystack ARR | Exits |

|---|---|---|

| Bull | $250M | $15B |

| Base | $200M | $10B |

| Bear | $150M | $5B |

Call: Paystack stack = 50% of next 10 unicorns.

References

- https://support.paystack.com/en/articles/4513922

- https://www.linkedin.com/posts/paystack_how-paystack-manages-payment-disputes-across-activity-7360610912413609984–ptd

- https://trova.health/faq-9-2-10

- https://support.paystack.com/en/articles/2124994

- https://nairametrics.com/2025/07/26/e-payment-transactions-in-nigeria-hit-n284-9-trillion-in-q1-2025/

- https://www.agustoresearch.com/report/2025-fintech-industry-report/

- https://nairametrics.com/2025/10/08/e-payments-in-nigeria-hit-n384-trillion-in-july-cbn/

- https://www.ericosiakwan.com/2025/12/22/the-africa-tech-ecosystem-in-november-2025-record-exits-cautionary-tales/

- https://insights.techcabal.com/the-state-of-startup-exits-in-africa-in-5-charts/