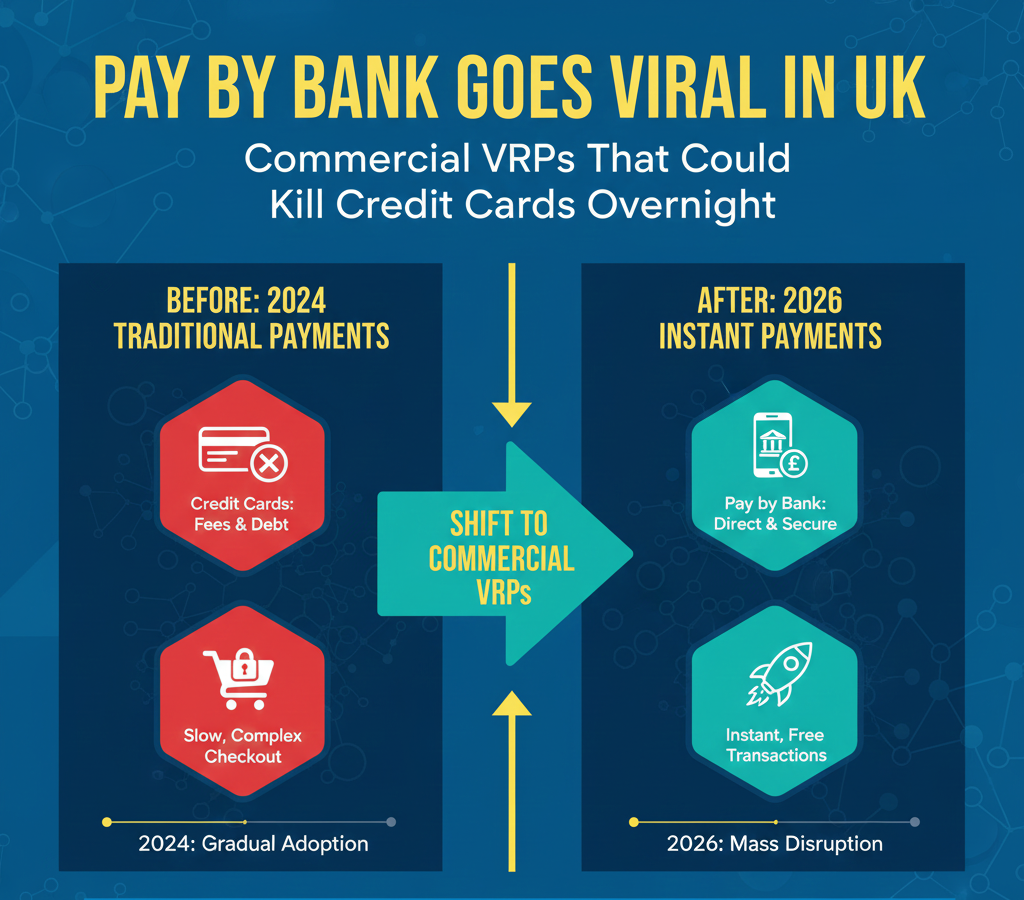

Open banking-powered Pay by Bank is exploding in the UK, with user numbers hitting 15.16 million by July 2025—nearly one in three adults—and transaction volumes reaching record highs of 29.89 million in the same month.[1][2] Commercial Variable Recurring Payments (VRPs), a key enabler, are piloting in retail and SaaS billing, positioning account-to-account (A2A) payments as a direct rival to credit cards by slashing fees and boosting speed.[4]

What is Pay by Bank and Why the Hype?

Pay by Bank leverages open banking APIs for direct, real-time transfers from a user’s bank account to merchants, bypassing card networks. This A2A model promises lower costs—no interchange fees—and instant settlement, appealing to businesses weary of credit card margins.[3] In 2025, UK open banking payments surged 70% year-on-year, comprising 7% of all Faster Payments (31 million in March alone).[1] By July, active users grew to 15.16 million from 13.3 million in March, a 34% YoY jump.[1][2]

VRPs, introduced under open banking, allow recurring payments with user-defined rules—like spending caps—enhancing security over traditional cards. They hit 13% of open banking payments by March 2025, signaling strong momentum.[1] Globally, open banking users topped 470 million in 2025, with UK volumes at 120 billion transactions annually.[1]

Record Adoption: Data That Proves the Viral Spread

UK open banking isn’t niche anymore. In March 2025, 18.4% of consumers and small businesses with online accounts (about 1 in 5) were active, driving 31 million payments—1 in 13 Faster Payments.[1] July marked a peak at 29.89 million transactions and 15.16 million users.[1][2] Projections show adoption crossing 50.7% of adults (27.5 million users) in 2025, heading to 60.5% by 2026.[1]

Bank participation is near-universal: 95% of UK banks joined the initiative in 2025.[1] Monthly payments averaged 22 million, with ecosystems logging 2 billion API calls in peak months.[1] The UK’s digital payments market, valued at USD 11.7 billion in 2025, grows at 15.2% CAGR to 2034, fueled by open banking and Faster Payments upgrades.[6]

| Metric | 2025 Data | Growth Insight |

|---|---|---|

| Active Users | 15.16M (July) | 40% YoY from 2024[1][3] |

| Monthly Transactions | 29.89M (July) | 70% YoY[1] |

| VRP Share | 13% of payments | March 2025[1] |

| Faster Payments Share | 7% | March 2025[1] |

Commercial VRPs: The Credit Card Killer?

Commercial VRPs extend consumer VRPs to businesses, enabling ‘Pay by Bank’ for subscriptions, e-commerce, and bills. Pilots in retail and SaaS show doubled payment initiation volumes YoY.[4] Unlike cards, VRPs cut merchant fees (often 1-3% for cards vs. near-zero for A2A) and offer real-time confirmation, reducing fraud and chargebacks.[3][6]

Could they kill credit cards overnight? Not quite, but the threat is real. Cards still dominate via rewards and credit access, yet A2A’s rise aligns with trends: contactless at 60%+ of transactions, cash under 10%.[5] API-based integrations grow fastest in digital payments, driven by open banking.[6] In 2026, A2A mainstreaming accelerates in instant-payment markets like the UK.[3]

Real-World Examples and Business Impact

- Retail & SaaS Billing: Pilots use VRPs for seamless subscriptions, with merchants reporting cost savings and higher conversion via bank-trusted flows.[4]

- Small Businesses: Tap to Pay on mobiles lets traders accept A2A anywhere, complementing open banking’s low-friction model.[5]

- Neobanks & Fintechs: 26% of UK consumers use neobanks, holding 5.9% primary relationships by mid-2025, integrating VRPs for profitability.[7]

Utilities and retailers embed Pay by Bank, fostering ecosystems with payments, rewards, and identity in one flow—deepening loyalty while eroding card reliance.[6]

Challenges and Roadblocks to Overnight Disruption

Despite hype, hurdles remain. Consumer trust in AI-driven finance is key, with 28 million adults using it but demanding transparency.[7] Mobile banking dominates (68% biweekly use), yet card habits persist for credit and rewards.[7] Regulatory pushes like PSD2 ensure 94% European bank compliance, but scaling commercial VRPs needs broader adoption.[1]

Projections to 2026 show strong growth, but cards won’t vanish instantly—NFC holds 41.27% market share in 2025.[6]

Conclusion

Pay by Bank and commercial VRPs are viral in the UK, with 15M+ users and record volumes signaling a credit card shake-up. While not overnight doom, lower costs and A2A efficiency position them as serious contenders in 2026’s digital finance landscape.

References

- https://sqmagazine.co.uk/open-banking-adoption-statistics/

- https://www.openbanking.org.uk/news/open-banking-surges-to-15-million-uk-users-as-july-marks-record-adoption/

- https://www.fabrick.com/en-gb/insights/blog/open-banking-2026-trends/

- https://eps.edenred.com/blog/payment-trends-in-2026-edenred-payment-solutions

- https://npi.uk/payment-trends-uk-2026-what-businesses-need-to-know/

- https://straitsresearch.com/report/digital-payments-market/united-kingdom

- https://rfi.global/the-future-of-uk-financial-services-five-trends-to-watch-in-2026/