Germany, Europe’s largest economy, finds itself trapped in a prolonged period of economic stagnation that shows no immediate signs of relief. As 2025 progresses, financial market experts and economic forecasters paint a sobering picture: Germany’s economy is expected to grow by just 0.1 percent this year, with around 30 percent of surveyed experts predicting a third consecutive year of recession[1]. This extended period of economic inactivity represents Germany’s longest stagnation in seven decades, a stark contrast to the growth trajectory that powered European prosperity for generations[2]. The implications extend far beyond Germany’s borders, raising critical questions about the eurozone’s economic resilience and the continent’s competitive standing in an increasingly uncertain global environment.

The Depth of Germany’s Economic Crisis

To understand the severity of Germany’s current predicament, consider this sobering statistic: over the past five years, Germany’s economy has grown by just 0.1 percent since 2019[3]. During the same period, the United States economy has expanded by 12 percent, highlighting the dramatic divergence between two major developed economies. This stagnation is not a temporary cyclical downturn but rather reflects deeper structural challenges that have accumulated over years of underinvestment, demographic headwinds, and geopolitical disruption.

The most recent economic data confirms this troubling trend. In the third quarter of 2025, Germany’s gross domestic product stagnated compared to the previous quarter, with growth remaining at approximately 0.0 percent[2]. While the economy narrowly avoided a technical recession—which would require two consecutive quarters of negative growth—this represents merely the absence of crisis rather than genuine recovery. Year-on-year, the economy managed only 0.3 percent growth, a figure that barely registers above zero and offers little comfort to policymakers or citizens[2].

Private consumption has become a particular drag on economic activity, declining by 0.3 percent quarter-on-quarter in recent months, while net exports have also weighed on overall performance[2]. These declines reflect both weakened consumer confidence and the impact of international trade tensions, particularly the new US tariff regime that has fundamentally altered the global trade landscape.

Structural Challenges Beyond Cyclical Weakness

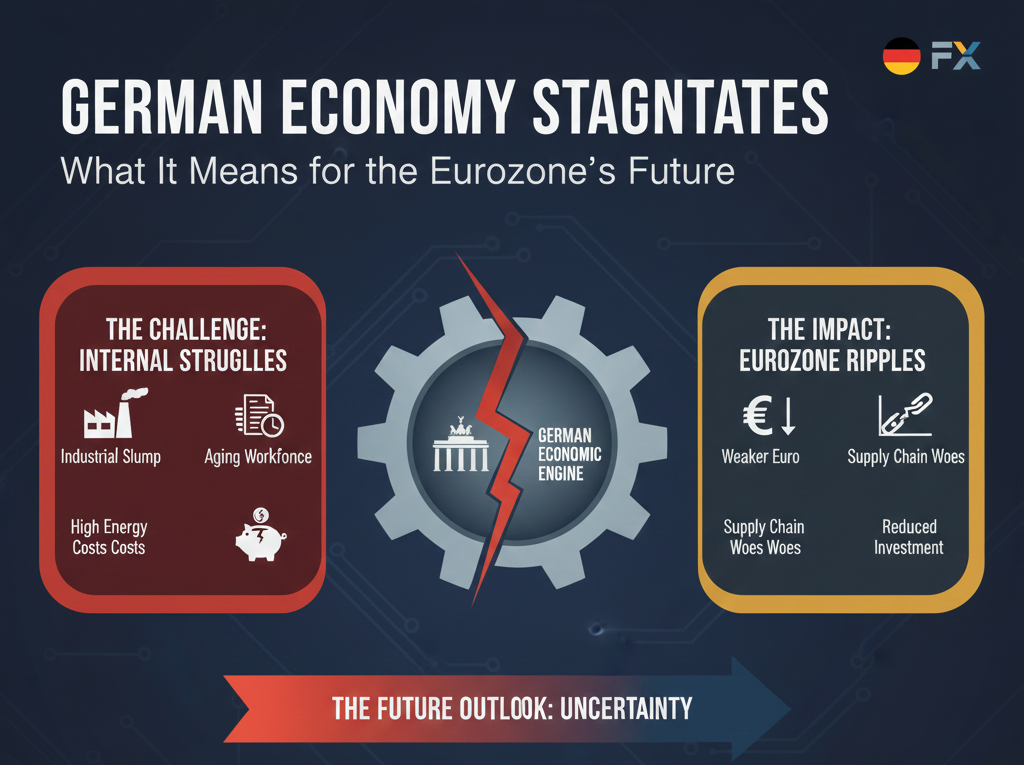

Germany’s economic malaise cannot be attributed to temporary factors alone. The combination of cyclical headwinds and structural changes has created what economists describe as “apparently never-ending paralysis”[2]. Companies across all sectors report persistently weak demand for their goods and services, alongside a deterioration in their international competitive position[1]. Manufacturing and construction industries have recorded significant declines, sectors that traditionally anchored German economic strength.

Demographic trends pose a particularly intractable challenge. Germany’s aging population and shortage of qualified workers will severely curtail the economy’s growth potential in coming years[2]. To return to the growth path experienced over the previous three decades, Germany would need to achieve annual economic growth of 2.5 percent for the next six years—a target that most experts consider nearly impossible to achieve given current structural constraints[2].

The export-driven model that historically defined German economic success faces mounting pressure. US import tariffs, including a general base tariff of 10 percent on all imports and reciprocal tariffs reaching as high as 125 percent on certain countries, have significantly impacted German exporters[1]. These trade barriers have created substantial uncertainty about the future viability of Germany’s traditional export-oriented business model.

Implications for the Broader Eurozone

While Germany stagnates, the eurozone presents a somewhat more optimistic picture. The EU economy is expected to grow by 0.7 percent in 2025, more than seven times Germany’s projected growth rate[1]. This divergence reveals a critical vulnerability: Europe’s economic performance increasingly depends on whether other member states can compensate for Germany’s weakness. However, this cannot be a sustainable long-term solution.

Germany’s prolonged stagnation creates ripple effects throughout the eurozone. As Europe’s largest economy, Germany serves as a major market for other European nations’ exports. When German consumers and businesses retrench, demand for imports from neighboring countries declines, creating headwinds for their growth as well. Additionally, Germany’s fiscal constraints—despite new government stimulus measures—limit its ability to serve as a locomotive for European growth through increased imports or investment in regional projects.

The inflation outlook presents another dimension of concern. While financial market experts see no increased inflation risk for Germany or the broader eurozone, with expectations of 2.3 percent inflation in coming years—just above the European Central Bank’s two percent target—the picture differs markedly for the United States[1]. US inflation is expected to reach 3.2 percent in 2025 and 3.1 percent in 2026, creating divergent monetary policy trajectories between the Federal Reserve and ECB. This divergence could further complicate Germany’s export competitiveness and capital flows within the eurozone.

Global Economic Uncertainty and Trade Policy

The current US trade policy has introduced a “massive increase in global economic uncertainty” according to economic forecasters[1]. The dynamic nature of American tariff policy has created a wide range of possible outcomes for the global economy. For the United States itself, forecasts show a standard deviation of around one percentage point for 2025 GDP growth, meaning that in pessimistic scenarios, the US economy could contract by as much as 2.5 percent[1]. Such volatility in the world’s largest economy inevitably transmits shocks throughout the global system, including to Germany and the eurozone.

Germany’s economy appears particularly vulnerable to these external shocks. The combination of tariffs, a stronger euro exchange rate, political tensions, and elevated uncertainty continues to hold back investment and consumption[2]. Businesses facing such headwinds typically delay capital expenditure decisions, reduce hiring, and adopt defensive strategies rather than pursuing growth initiatives.

Fiscal Policy as a Potential Path Forward

Germany’s new government has recognized the urgency of the situation and introduced fiscal stimulus measures designed to reignite economic growth. These measures include accelerated depreciation for businesses, reductions in value-added tax for the hospitality industry, electricity tax relief for manufacturing, lower grid fees, and increased commuter allowances[1]. Fiscal stimuli are projected to amount to 9 billion euros in 2025, 38 billion euros in 2026, and 19 billion euros in 2027.

If these measures are implemented rigorously and the high level of uncertainty recedes, fiscal policy could potentially haul the German economy out of its prolonged crisis[1]. Optimistic scenarios suggest that quarterly GDP growth rates could reach up to 0.4 percent, underutilization of economic capacities could be reduced, and a genuine recovery phase could be triggered. However, such outcomes depend critically on policy execution and the external environment improving.

The fiscal deficit is expected to increase to 3.0 percent of GDP in 2026 and 2.7 percent in 2027 as these stimulus measures take effect[1]. While this represents a departure from Germany’s traditional fiscal conservatism, many economists argue it represents a necessary and appropriate response to the depth of the economic crisis.

Looking Ahead: Recovery or Continued Stagnation?

Forecasts for 2026 and 2027 offer modest grounds for optimism. Economic output is expected to increase by 1.3 percent in 2026 and 1.6 percent in 2027, assuming fiscal measures are implemented effectively[1]. These growth rates, while still modest by historical standards, would represent a meaningful improvement over the current stagnation. However, significant risks remain, including potential escalation of trade tensions, geopolitical instability, and the possibility that fiscal stimulus proves insufficient to overcome structural headwinds.

The very short-term outlook for the final quarter of 2025 remains uninspiring, with economists expecting the economy to remain in stagnation[2]. Traditional leading indicators, such as the Purchasing Managers’ Index (PMI), have provided misleading signals, with the PMI composite remaining above the 50-mark since summer despite economic stagnation, suggesting that old rules of thumb no longer reliably predict economic expansion[2].

Conclusion: A Critical Juncture for Europe

Germany’s prolonged economic stagnation represents far more than a domestic German problem—it poses a fundamental challenge to the eurozone’s future prosperity and Europe’s competitive position in the global economy. The combination of cyclical weakness, structural challenges, demographic headwinds, and external trade shocks has created a uniquely difficult environment for policymakers. The success or failure of Germany’s new fiscal stimulus measures will significantly influence not only German economic prospects but also the growth trajectory of the entire eurozone.

The path forward requires not only effective fiscal policy implementation but also structural reforms to address Germany’s long-term competitiveness challenges. Without meaningful progress on both fronts, Germany risks remaining trapped in stagnation, with cascading consequences for European economic performance. The stakes extend beyond economic statistics—they encompass employment, social stability, and Europe’s ability to maintain its living standards and influence in an increasingly competitive global environment. The coming months and years will determine whether Germany can break free from its longest period of economic inactivity in seven decades or whether Europe’s largest economy faces an extended period of diminished growth and influence.

References

- https://www.zew.de/en/press/latest-press-releases/german-economy-stagnates-in-2025-no-increase-in-inflation-risk

- https://think.ing.com/snaps/german-gdp-growth-3q25-2nd-estimate/

- https://www.imf.org/en/publications/fandd/issues/2025/06/making-germany-grow-again-ulrike-malmendier

- https://www.ifo.de/en/facts/2025-09-04/ifo-economic-forecast-autumn-2025-fiscal-policy-may-haul-german-economy-out-crisis

- https://www.intereconomics.eu/contents/year/2025/number/1/article/the-current-economic-situation-in-germany-in-the-context-of-previous-crises.html

- https://www.spglobal.com/ratings/en/regulatory/article/economic-research-economic-outlook-europe-q1-2026-germanys-fiscal-reawakening-s101657610