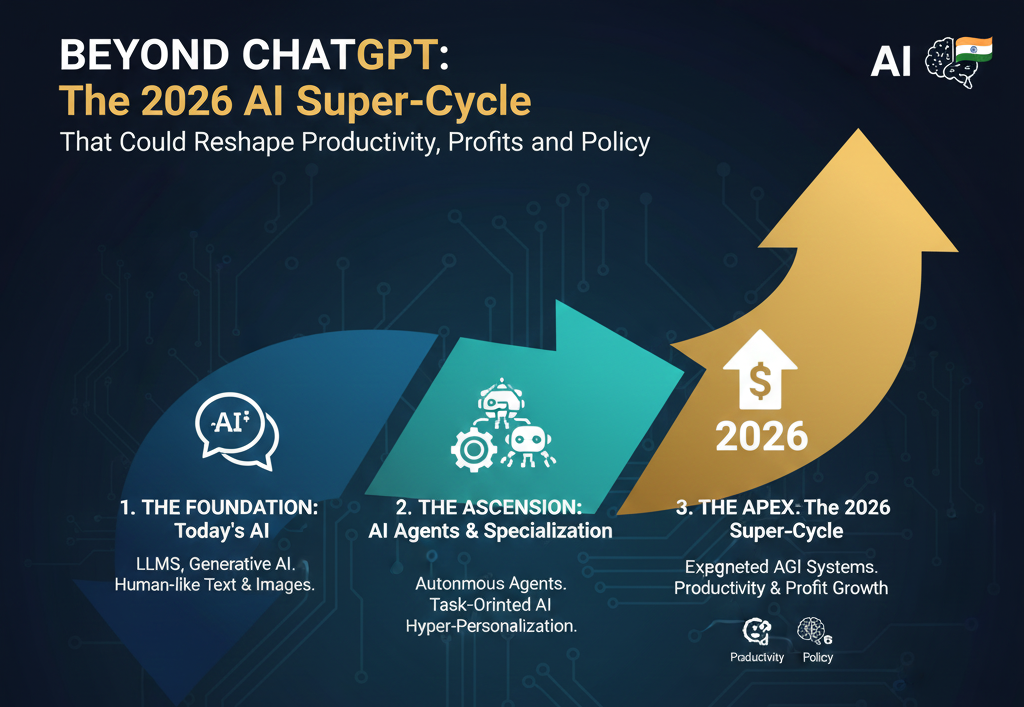

Generative AI moved from curiosity to core infrastructure in barely two years. As we look toward 2026, major banks, chipmakers and strategists increasingly describe what is coming as an AI super‑cycle – a multi‑year wave of spending and adoption that could reshape productivity, corporate profits and economic policy. Yet alongside the optimism, a new vocabulary has emerged: AI winter, air pocket, and over‑build.

This article examines what the 2026 AI super‑cycle could realistically look like, drawing on the latest market research, analyst calls and macro forecasts. It goes beyond ChatGPT‑style demos to focus on infrastructure, monetization and the policy responses likely to follow.

From chatbot moment to infrastructure super‑cycle

The initial phase of the AI boom was application‑led: ChatGPT, image generators and copilots captured public attention. The current phase, however, is dominated by infrastructure build‑out – data centers, specialized chips, networking and memory – with capital expenditure at hyperscalers reaching historic levels.

Analysts at several Wall Street firms argue that this infrastructure wave will keep building into 2026 as enterprises shift from pilots to production workloads and hyperscalers compete on model performance and latency.Semiconductor suppliers like Nvidia, Broadcom and ASML are central to this story, with AI‑related demand driving both capacity expansion and pricing power.Morgan Stanley, for example, expects tight supply and firm pricing across critical memory and specialty semiconductor segments into the middle of the decade.

At the same time, some strategists warn that valuations in leading AI names have already capitalized a very optimistic view of long‑run profits.BCA Research recently estimated that roughly $9–$12 trillion in U.S. equity market gains since late 2022 are difficult to explain without assuming substantial AI‑driven upside.That gap between expectations and delivered productivity is at the heart of the super‑cycle debate.

2026 as a pivot: from build‑out to monetization

By 2026, many analysts expect AI to reach a pivotal transition: from predominantly capex‑driven growth to more visible revenue and productivity gains.

- Cloud and chip suppliers are guiding for continued strength in AI infrastructure spending through at least the mid‑2020s, supported by both training and inference workloads.

- Broadcom has highlighted a potential acceleration of demand for next‑generation accelerators in the back half of 2026 as customers scale inference to monetize their platforms, not just train models.

- Nvidia and other leading GPU vendors are modeling tens of billions in incremental data‑center revenue tied to AI workloads in their mid‑decade outlooks, reinforcing the narrative of an extended monetization runway.

On the software side, analysts such as Dan Ives at Wedbush describe AI as the engine of a “massive super‑cycle,” with the sector still in the early innings of what he calls the Fourth Industrial Revolution.His thesis: 2026 will see a clear shift from investors paying for AI promise to paying for demonstrated earnings leverage at enterprise software vendors, cloud providers and industry vertical specialists.

What the super‑cycle could mean for productivity

The central economic question is how far AI can move the productivity needle. BCA Research frames three structural paths for AI

- A low‑probability breakthrough in artificial general intelligence (AGI), with transformative macro effects (assigned ~5% probability).

- A base case in which AI delivers moderate productivity gains at the macro level, on the order of 0.4–0.5 percentage points of annual output growth.

- A downside scenario where data‑center over‑investment leads to a productivity “bust” and disappointing returns on capital.

That base case – modest but sustained productivity uplift – is critical. It implies meaningful efficiency improvements in sectors like software development, customer service, design and professional services, but not the kind of step‑change that would on its own justify today’s most aggressive valuation assumptions.

Bank of America’s equity strategy team has echoed a related caution. In a recent note, they warned that markets may hit an “AI air pocket” around 2026 as investors confront the lag between heavy AI capex and clear, broad‑based monetization, especially if consumer spending slows at the same time. Their concern is not that AI will fail, but that the timing of payoff could be bumpier than current narratives suggest.

Profits: winners, laggards and the risk of an ‘AI winter’

The profit implications of an AI super‑cycle will be highly uneven.

Infrastructure and enablers

Chipmakers, networking suppliers and lithography equipment vendors are already seeing outsized benefit from AI demand, with some forecasting double‑digit earnings CAGRs into 2030 on the back of increased AI intensity in data centers and memory.Names like ASML are being positioned by banks as core beneficiaries of a multi‑year up‑cycle as customers add advanced process layers and expand AI‑optimized capacity.

Adopters and software platforms

On the adoption side, Bank of America and others increasingly emphasize AI adopters – banks, industrials, health care and consumer firms using AI to automate workflows – rather than just hyperscalers. For these firms, the earnings story hinges on whether AI can:

- Raise revenue via personalization, faster innovation and new services.

- Cut costs through automation of routine cognitive tasks.

- Improve capital efficiency by reducing trial‑and‑error in R&D and operations.

However, not all adopters will see immediate margin gains. Many will face overlapping costs: maintaining legacy systems while funding AI experimentation, retraining staff and upgrading infrastructure. The firms that win are likely to be those that can redesign processes – not just bolt AI onto existing workflows.

The specter of an ‘AI winter’

Despite the bullish super‑cycle narrative, BCA Research has raised the probability of an AI winter – a period of cooling investment and softer tech valuations – beginning sometime in the next one to three years. They argue that if realized productivity gains remain in the “moderate” band while capex and expectations stay extreme, a correction becomes increasingly likely.

This does not mean AI adoption stops; rather, capital becomes more selective, weaker business models are flushed out and investors refocus on measurable ROI. For long‑term adopters, such a phase could be an opportunity to build at lower cost, while for heavily levered infrastructure players it could be a stress test.

Policy pressure: power, jobs and regulation by 2026

Policy is emerging as the third force shaping the 2026 AI super‑cycle. Governments are grappling with three intertwined challenges: power consumption, labor markets and governance.

Power and physical limits

AI‑optimized data centers are extraordinarily power‑hungry. Bank of America notes that AI hyperscalers have recently been more capital intensive than major oil companies, with tech sector debt issuance rising sharply to fund this build‑out. As grid constraints tighten and electricity prices fluctuate, regulators and utilities are starting to question the pace and location of new AI clusters.

By 2026, businesses may face:

- More stringent environmental and reporting requirements for large data‑center projects.

- Incentives to co‑locate AI facilities near renewable generation or to invest in efficiency‑enhancing hardware.

- Potential prioritization of industrial or residential power needs over purely speculative compute expansion in constrained regions.

Jobs, wages and inequality

AI’s impact on labor is poised to become a dominant political issue. Bank of America’s strategy team explicitly worries about the tension between AI taking jobs and the need for resilient consumption to support earnings growth in 2026 and beyond. If AI primarily boosts profits while suppressing wage growth for certain segments, pressure for redistributive policy – from targeted taxes to worker retraining subsidies – will increase.

Policymakers are likely to focus on:

- Funding large‑scale reskilling programs for workers in at‑risk white‑collar and routine cognitive roles.

- Updating labor protections and benefits for AI‑mediated gig and platform work.

- Exploring tax frameworks that balance incentives for innovation with support for displaced workers.

Regulation, safety and competitive dynamics

Alongside economic concerns, governments are accelerating AI‑specific regulation around safety, transparency and competition. While details vary by jurisdiction, three themes are converging globally:

- Model oversight – requirements for documenting training data, testing for bias and reporting systemic risks in frontier models.

- Usage governance – sector‑specific rules for AI in finance, health care, hiring and surveillance.

- Competition and antitrust – scrutiny of exclusive partnerships and vertically integrated AI stacks that could entrench a small number of dominant players.

By 2026, these rules are unlikely to halt the AI super‑cycle, but they may reshape where value accrues – for example, favoring open ecosystems, smaller models that can run on‑premises, or providers that can demonstrate strong control over data lineage and safety processes.

Strategic implications for businesses and investors

Against this backdrop, how should decision‑makers think about the 2026 AI landscape?

For businesses

- Move from experimentation to process redesign: The productivity upside lies less in deploying generic copilots and more in deeply integrating AI into workflows – underwriting, supply‑chain optimization, coding pipelines, and customer support.

- Track total cost of AI ownership: Factor in compute, integration, security, compliance and change‑management costs when assessing ROI; cheap prototypes can mask expensive production realities.

- Build governance early: Establish policies for data quality, human‑in‑the‑loop review and model monitoring to stay ahead of regulators and reduce operational risk.

For investors

- Differentiate infrastructure from adoption plays: Infrastructure winners may experience more cyclicality if an AI “air pocket” or mini‑winter hits; high‑quality adopters with measurable efficiency gains could prove more resilient.

- Interrogate productivity assumptions: Be skeptical of valuations that implicitly assume AGI‑level disruption when the base‑case research still points to moderate, though positive, macro productivity gains.

- Watch policy and power constraints: Regulatory shifts around data privacy, safety and grid access may create both headwinds and new moats for certain business models.

Conclusion: A powerful but uneven wave

The 2026 AI super‑cycle is unlikely to be a smooth, exponential curve. The evidence points to a powerful but uneven wave: robust infrastructure spending, gradually improving productivity, pockets of extraordinary profitability – and real risks of over‑build, valuation excess and policy backlash.

Beyond ChatGPT, the question for leaders is not whether AI will matter, but how quickly they can translate today’s experimental tools into disciplined, governed systems that measurably improve outcomes. Those who treat AI as a long‑term capability – rather than a short‑term story – will be best positioned, whichever path the super‑cycle ultimately takes.

References

- https://www.investing.com/news/stock-market-news/5-big-analyst-ai-moves-top-picks-for-2026-unveiled-as-ai-winter-risk-grows-4393653

- https://www.morningstar.com/news/marketwatch/20251203173/an-ai-air-pocket-and-a-struggling-consumer-could-become-a-double-whammy-for-stocks-in-2026-bank-of-america-predicts

- https://io-fund.com/ai-stocks/nvidia-stock-ai-monetization-supercycle

- https://www.thestreet.com/investing/stocks/popular-analyst-unveils-two-new-ai-stocks-for-2026

- https://longbridge.com/news/268684162