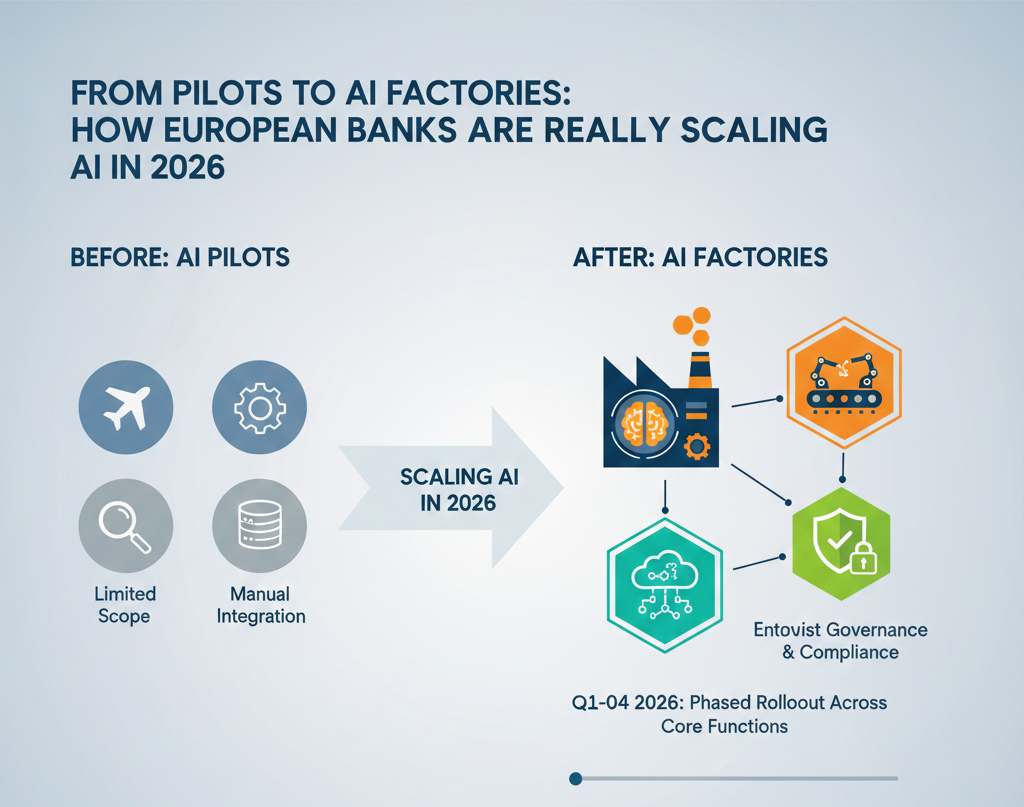

European banks are accelerating AI adoption in 2026, moving beyond experimental pilots to build scalable “AI factories” that promise significant cost savings and operational efficiencies, fueling a sector rally amid supportive regulations like the EU AI Act.[1][2]

The AI-Driven Rally in European Banking Stocks

After a stellar 2025, European bank shares are poised for further gains in 2026, propelled by robust earnings and AI-enabled cost reductions. Investors, undeterred by recession fears or ECB rate cuts, have revised expectations upward for the sector. A key attraction is the scarcity of pure tech plays in Europe, pushing capital toward banks as AI beneficiaries in traditional sectors.[1]

Banks are deploying AI for operational efficiency, fraud detection, and staff cost reductions. BlackRock’s chief investment officer for fundamental equities, Helen Jewell, highlights banks as “cost winners” in the AI narrative. European bank stocks trade at a discount—around 1.17 times price-to-book value, 40% below 2007 peaks and under U.S. peers at 1.7 times—making them appealing.[1]

Performance underscores this: Société Générale shares surged 140% in 2025, Commerzbank 125%, and Barclays nearly 70%. The European bank index rose over 60%, dwarfing broader market gains. Goldman Sachs forecasts cost growth at just 1% annually through 2027, with cost/income ratios improving 130 basis points year-on-year into 2026.[1]

Regulatory Tailwinds: The EU AI Act and EBA Support

The EU AI Act, effective from August 2024 and fully applicable by August 2026 (with exceptions), aligns well with banking regulations, showing no major conflicts. The European Banking Authority (EBA) confirmed on November 21, 2025, no immediate need for new guidelines.[2]

In 2026-2027, the EBA will foster a common supervisory approach, enhance cooperation among national authorities, and contribute to the AI Office and AI Board Subgroup on Financial Services. This framework enables banks to scale AI confidently, embedding compliance by design amid rising ESG and data protection demands.[2][4]

Overcoming Legacy Hurdles: Building AI Foundations

Scaling AI requires addressing fragmented data, legacy systems, compliance pressures, and cultural resistance. Many initiatives remain stuck in proofs-of-concept with weak governance. Deloitte’s 2026 outlook positions this year as pivotal for banks aspiring to be fully AI-powered, emphasizing agentic AI—autonomous agents that initiate and execute actions.[3]

Banks must integrate compliance into agents via permissions, auditability, and human oversight. Foundations include cloud infrastructure, multi-agent orchestration, and robust data governance for quality, lineage, and accessibility. Shifting to an “AI agent-at-the-center” model, with humans overseeing key decisions, demands cultural resets and top-down vision.[3]

“AI for data” agents can create feedback loops improving data quality, enforcing privacy, and accelerating model cycles—lowering costs and easing audits. Banks should prioritize pilots with scorecards assessing data readiness, focusing on high-impact areas like customer risk summarization, alert scoring, and case drafting.[3]

Real-World Applications: Fraud, Credit, and Beyond

European banks lead with AI in fraud detection and credit scoring for faster, more accurate decisions. Financial crime teams deploy AI across compliance lifecycles: enhancing due diligence, perpetual KYC, behavioral monitoring, and alert triage—auto-clearing low-risk cases while summarizing complex ones.[3][5]

10x Banking’s 2026 trends report stresses embedding AI into core operations for real-time risk visibility, regulatory interpretation, and supply chain assurance. Resilience by design, compliant with the EU AI Act, turns governance into a growth driver. Partners report AI automating compliance updates in real-time.[4]

McKinsey’s prior estimate of $340 billion in annual global banking value from AI, via 20% operational cost drops, underscores long-term potential—though full savings may take years, they boost valuations.[1]

Risks and Resilience in the AI Era

Despite optimism, warnings persist: IMF and Bank of England caution against AI exuberance akin to dot-com busts. ECB highlights unprecedented risks from geopolitics, trade shifts, climate crises, and dollar volatility.[1]

Yet, economic resilience supports banks, with euro zone business lending at 2.9%—near highs—and household loans at a 2.5-year peak of 2.8%. BlackRock anticipates 20-25% shareholder returns via dividends and buybacks over three years, plus M&A like Mediobanca’s takeover.[1]

Conclusion

In 2026, European banks are transforming pilots into AI factories, leveraging regulatory clarity, investor enthusiasm, and practical applications to drive efficiency and growth. Success hinges on foundational investments and balanced risk management, positioning the sector as a European AI success story.

References

- https://www.rte.ie/news/business/2025/1230/1550903-ai-boom-to-supercharge-european-banks-rally/

- https://www.regulationtomorrow.com/france/fintech-fr/eba-factsheet-ai-act-implications-for-the-eu-banking-and-payments-sector/

- https://www.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-outlooks/banking-industry-outlook.html

- https://www.10xbanking.com/insights/core-banking-trends-2026-ai-resilience-real-time-transformation

- https://www.retailbankerinternational.com/comment/the-shape-of-finance-in-2026-how-ai-esg-and-global-risk-are-redefining-banking-and-investment-strategy/