Sophisticated fraud attacks in Europe have surged, driving explosive growth in AI fraud detection as businesses and regulators race to counter AI-enabled threats like deepfakes and synthetic identities.

The Surge in Sophisticated Fraud Attacks

Europe’s fraud landscape shifted dramatically in 2025, with complex, multi-step fraud attacks rising 180% year-on-year globally, a trend hitting the region hard despite overall fraud rates declining by 14.6% in Europe.[1][3] Sumsub’s Identity Fraud Report 2025-2026 highlights a “Sophistication Shift,” where attackers combine digital manipulation, synthetic content, and behavioral mimicry in single verification attempts, requiring fewer tries to succeed but causing greater damage.[1] This evolution leaves traditional systems outdated, pushing companies toward advanced AI defenses.

In the UK, identity fraud dominated 59% of cases in 2024, with account takeovers up 76% and SIM swap fraud exploding over 1,000%.[4] Over a third of UK businesses faced AI-related fraud in Q1 2025, per Experian data.[4] Meanwhile, deepfake files ballooned from 500,000 in 2023 to 8 million in 2025, fueling fraud spikes.[2]

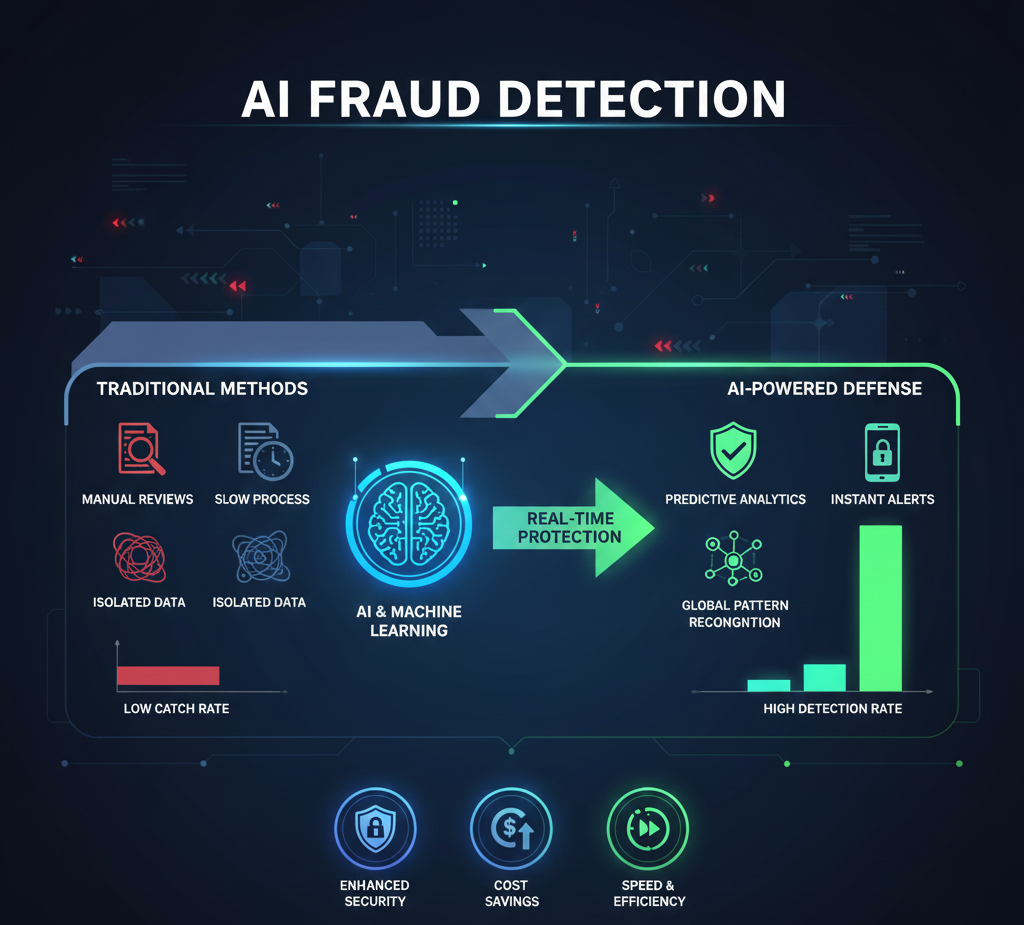

AI’s Dual Role: Weapon and Shield

AI powers both sides of the fraud equation. Criminals leverage accessible tools for realistic deepfakes, voice cloning, and synthetic identities, enabling scalable operations without expert skills.[1][4] Household AI products now contribute to falsified documents, with autonomous fraud agents executing end-to-end attacks autonomously.[1] This has led to AI fraud losses surpassing €1.3 billion in Europe, spurring startups like Italy’s IdentifAI to raise €5 million in July 2025 for deepfake detection platforms analyzing images, video, and voice.[8]

Yet AI is also revolutionizing detection. NICE Actimize’s 2025 EMEA Fraud Survey found 100% of UK respondents citing scams as a top threat, but financial institutions see GenAI, machine learning, and consortium analytics as key solutions for the next 12-18 months.[5] In the UK, 52% of businesses invested in AI analytics for fraud prevention.[4] The UK Government’s Fraud Risk Assessment Accelerator, an AI tool, recovered £480 million in fraud from April 2024 to April 2025—the largest annual sum ever—proving AI’s defensive prowess and leading to international licensing.[4]

Regulatory Momentum Fuels AI Adoption

Europe’s robust regulations are accelerating AI fraud detection investments. The EU AI Act, Denmark’s emerging laws, and the UK’s Online Safety Act address AI-enhanced threats, emphasizing coordinated defenses.[1] ECB Banking Supervision data shows a strong rise in AI use cases for fraud detection among European banks from 2023 to 2024, boosting efficiency in credit scoring and decision-making.[6] Banks are appointing Chief AI Officers and conducting self-assessments to align with standards.[6]

These frameworks deter opportunistic fraud—evidenced by a 20% drop in UK APP fraud cases in 2025, the lowest since 2021—thanks to real-time monitoring and enhanced verification mandated by the Financial Conduct Authority.[4] However, regulators note that while volumes stabilize, attack sophistication demands evolved compliance for cross-channel threats.[3]

Key Examples of AI Fraud Detection in Action

Practical deployments underscore the boom. NICE Actimize emphasizes GenAI’s promise in network analytics to tackle EMEA’s top fraud types like scams.[5] Feedzai’s 2025 trends scorecard highlights ongoing investments in fraud prevention amid rising financial crime.[7]

- UK Government AI Tool: Recovered £480 million, targeting Covid loan fraud and public sector scams.[4]

- European Bank AI Surge: Significant uptick in fraud detection models per ECB data.[6]

- Startup Innovation: IdentifAI’s €5M funding for multi-modal deepfake detection.[8]

Mastercard’s 2025 cybersecurity survey reveals consumer anxiety over AI scams, with Gen Z most engaged online, amplifying the need for proactive AI tools.[9]

Investment Trends and Future Outlook

AI detection markets grow at 28-42% CAGR, lagging behind deepfake threats expanding 900-1,740% in regions like North America and Central/Eastern Europe.[2] Europe’s mature ecosystems position it as a leader, with professionalized fraud operations expected to rise, alongside synthetic identities and fraud-as-a-service.[1] Defenses must evolve to verify AI agents in transactions, reshaping industries.[1]

Banks and firms prioritizing GenAI and consortium models will fare best, as traditional checks fail against coordinated attacks.[5] The NICE survey stresses technology’s pivotal role.[5]

Conclusion

AI fraud detection’s explosion in Europe counters a shift to smarter, deadlier attacks. With regulations, investments, and innovations aligning, the region is poised to balance AI’s paradox—harnessing it to protect against itself.

References

- https://www.fintechweekly.com/magazine/articles/europe-fraud-surge-sumsub-identity-fraud-report-2025-2026

- https://deepstrike.io/blog/deepfake-statistics-2025

- https://www.weforum.org/stories/2025/12/how-identity-fraud-is-increasing-in-the-age-of-ai/

- https://www.mishcon.com/news/fraud-trends-in-2025-the-ai-paradox

- https://www.niceactimize.com/press-releases/nice-actimize-2025-emea-fraud-survey-uncovers-the-top-financial-fraud-types-475

- https://www.bankingsupervision.europa.eu/press/supervisory-newsletters/newsletter/2025/html/ssm.nl251120_1.en.html

- https://www.feedzai.com/blog/fraud-prevention-trends-2025/

- https://www.eu-startups.com/2025/10/european-startups-get-serious-about-deepfakes-as-ai-fraud-losses-surpass-e1-3-billion/

- https://www.mastercard.com/global/en/news-and-trends/stories/2025/consumer-cybersecurity-survey.html