European banks are rapidly adopting artificial intelligence to enhance efficiency, sharpen decision-making, and manage risks, with credit scoring and fraud detection emerging as the top techniques according to the latest European Central Bank (ECB) data.[1][2] This surge aligns with the EU AI Act’s implementation, prompting banks to refine governance while scaling AI applications.

The Rise of AI in European Banking

AI adoption among European banks has accelerated significantly between 2023 and 2024, as revealed in the ECB’s 2025 supervisory newsletter. Banks are leveraging AI not just for innovation but to boost profitability through better risk assessment and real-time monitoring.[2] A McKinsey report cited in recent analyses notes that over 60% of European financial institutions now use AI for fraud detection, underscoring its centrality.[3]

This trend is driven by competitive pressures and regulatory evolution. The ECB conducted workshops with 13 banks in 2025, focusing on high-impact use cases, while the European Banking Authority (EBA) mapped AI Act obligations to existing financial rules, particularly for high-risk systems like creditworthiness assessments.[1][6]

1. AI for Credit Scoring: Precision and Personalization

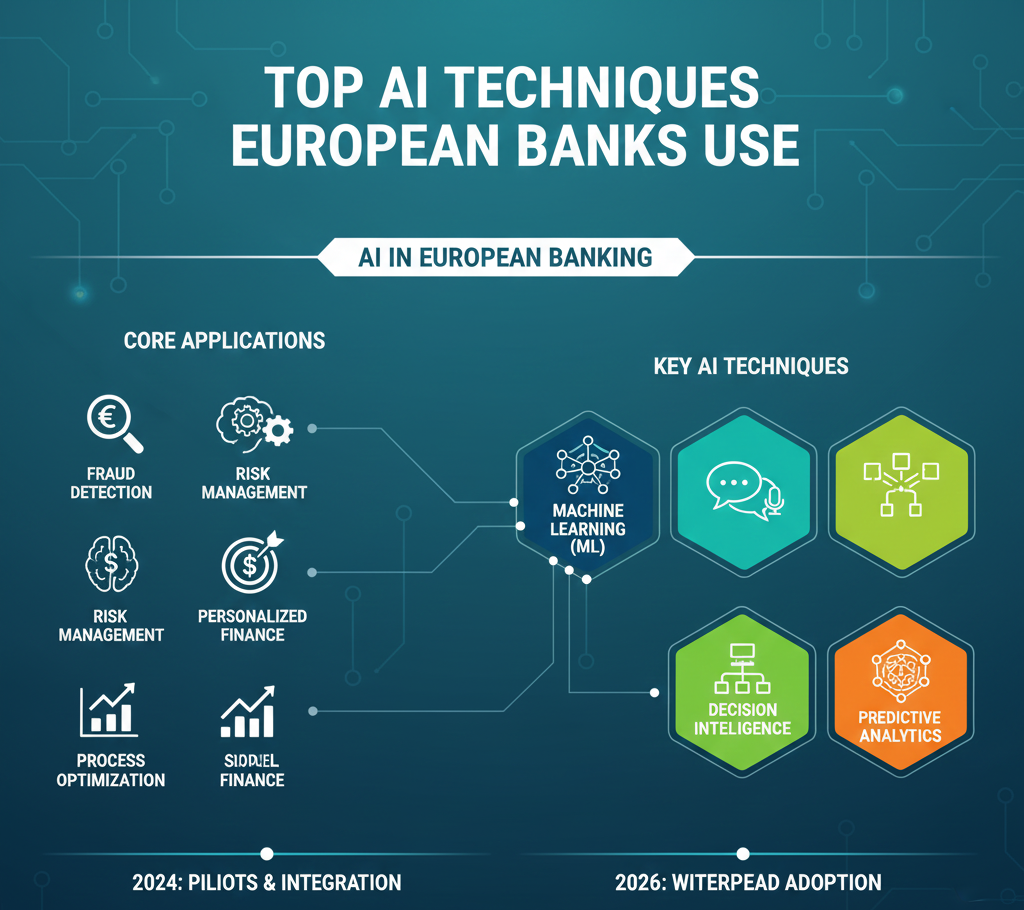

Credit scoring stands out as a flagship AI technique, where banks deploy advanced predictive analytics to tailor lending offers and reduce default rates. Decision tree-based models dominate this space, enabling more accurate risk evaluations and extended lending to underserved segments.[2]

According to ECB findings, these models improve process efficiency and customer service by analyzing vast datasets for individualized predictions. Banks report lower default rates and higher profitability, with AI enhancing traditional models’ accuracy.[2] For instance, leading institutions like BNP Paribas and ING have structured AI strategies to scale such applications responsibly.[3]

The EU AI Act classifies credit scoring as high-risk, requiring robust monitoring, logging, and incident reporting—obligations that complement existing prudential rules, as per the EBA’s analysis.[1]

2. Fraud Detection: Real-Time Pattern Recognition

Fraud detection is another cornerstone technique, with neural networks primarily powering real-time suspicious activity identification. ECB data shows a strong uptick in these use cases, allowing banks to prevent fraud proactively through pattern recognition.[2]

Over 60% of European financial firms employ AI here, per McKinsey insights, integrating it into operations for cost savings and security.[3][4] Banks in the ECB sample highlighted benefits like immediate transaction halts, reducing losses and enhancing trust. Decision trees also play a role alongside neural networks, depending on the scenario.[2]

Investors note AI’s role in operational efficiency, with BlackRock’s CIO Helen Jewell emphasizing banks as ‘cost winners’ in the AI boom, potentially driving share rallies into 2026.[4]

3. Governance and Risk Management Frameworks

Beyond specific techniques, European banks are embedding AI into governance structures. About half of the 13 banks reviewed by the ECB have established dedicated AI policies or committees, with some appointing Chief AI Officers for accountability.[1][2]

This addresses an ‘accountability gap’ in second- and third-line defenses, ensuring oversight. Banks are also conducting AI Act compliance self-assessments, inventorying systems, and aligning with digital strategies.[1] The EBA’s mapping confirms that current rules already cover many AI Act requirements, facilitating smoother integration.[6]

4. Emerging Techniques: Trading, Personalization, and Agentic AI

Banks are exploring AI in trading for execution improvement, arbitrage detection, and portfolio management, with 50% of trading firms using it strategically.[3] Recommendation engines and dynamic pricing further personalize services, boosting retention.

Agentic AI, combining multimodal data like text and behavioral patterns, enables scenario simulations such as portfolio stress tests directly in customer interfaces. This innovation is gaining traction among incumbents and startups.[3]

Oliver Wyman highlights how proprietary data and trust amplify AI’s value, urging banks to shift from pilots to profit-generating models.[5]

Regulatory Landscape and Future Priorities

The ECB’s 2026-2028 priorities emphasize monitoring AI strategies, governance, and risks, including data quality.[2] EU initiatives like the AI Innovation Package and AI Continent Action Plan support scalable adoption, with calls for balanced regulation to unlock GDP growth.[3]

Challenges persist in human oversight and validation, especially for embedded AI in compliance. Yet, with strong balance sheets and data troves, European banks are positioned to lead.[5]

Conclusion

European banks’ top AI techniques—credit scoring, fraud detection, and robust governance—are transforming finance amid EU AI Act compliance. As adoption scales, these innovations promise efficiency gains and competitive edges, provided risks are managed effectively.

References

- https://financialregulation.linklaters.com/post/102lw5y/eu-authorities-weigh-up-impact-of-ai-regulation-on-financial-services

- https://www.bankingsupervision.europa.eu/press/supervisory-newsletters/newsletter/2025/html/ssm.nl251120_1.en.html

- https://www.eurofi.net/wp-content/uploads/2025/10/eurofi-copenhagen-ai-implementation-in-the-financial-sector-sept-2025.pdf

- https://www.rte.ie/news/business/2025/1230/1550903-ai-boom-to-supercharge-european-banks-rally/

- https://www.oliverwyman.com/our-expertise/insights/2025/sep/how-ai-powers-europe-financial-future-for-profit.html

- https://finreg.aoshearman.com/eba-factsheet-on-implications-of-eu-ai-act-for-banking-and-payments-sector