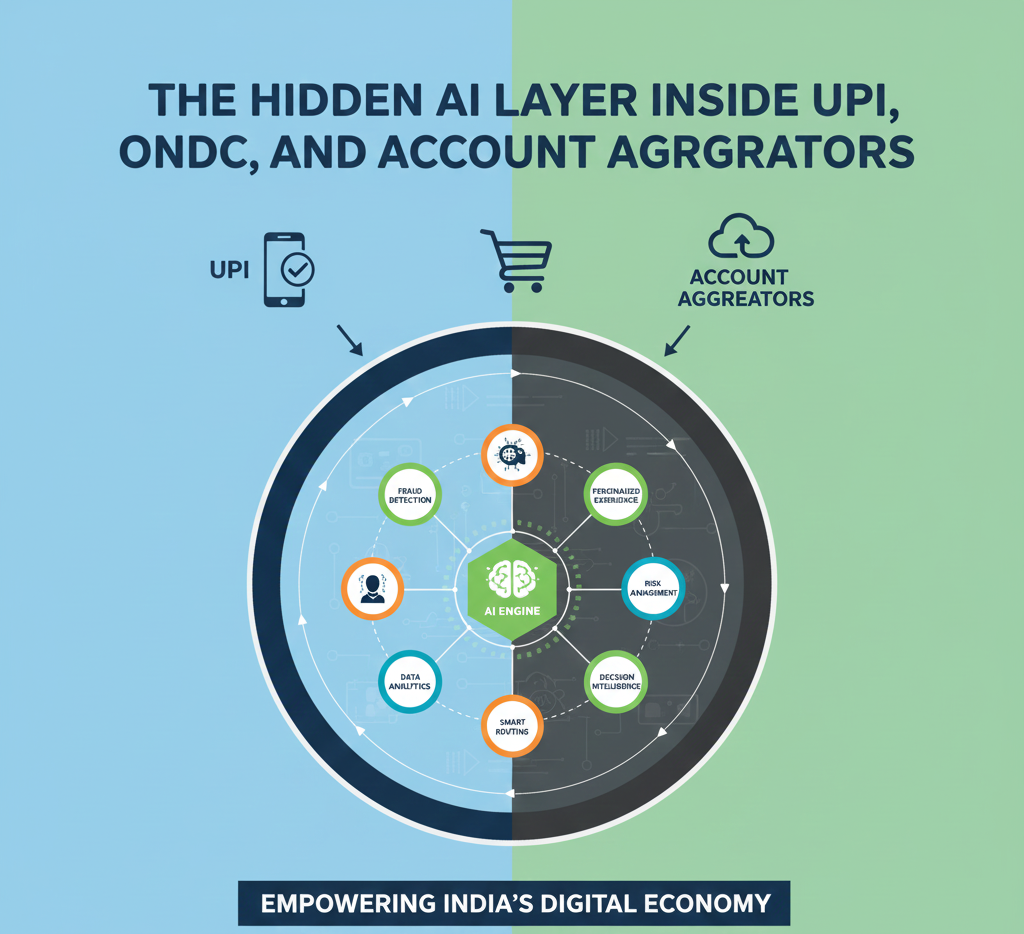

India’s digital rails—UPI, ONDC, and Account Aggregators—are evolving from rule-based systems to AI-augmented infrastructure over the next 3–5 years. AI will embed quietly in fraud scoring, credit models, dispute triage, and cross-sell opportunities, boosting efficiency across the stack.bfsi.economictimes.indiatimes+2

Infrastructure Layer (NPCI + AA)

NPCI currently relies on rules like device binding and SIM checks for UPI fraud prevention, but AI-driven risk scoring now analyzes transaction patterns and device profiles in real-time pilots with banks. Account Aggregators use consent-based data sharing under rules today; Sahamati Labs’ Google Cloud partnership integrates AI to enhance financial inclusion via smarter data handling. Over 3–5 years, federated AI models will reduce false positives by cross-referencing bank demographics with NPCI transaction data.medianama+2

Apps Layer (Banks, Fintech)

Banks and fintechs handle apps with rule-based fraud alerts and basic credit checks via CIBIL data. AI shifts this to behavioral models using UPI transaction history for alternative credit scoring, enabling 30–40% higher approvals for underserved users. ONDC apps scale via Kubernetes but add Vertex AI chatbots for multilingual buyer-seller interactions. Future AI will power cross-sell by analyzing spending patterns in real-time, like recommending loans post-UPI payments.cloud.google+2

Key Journeys Breakdown

AI transitions across user journeys follow a clear pattern from rules to augmentation.

| Journey | Rules-Based Today | AI-Augmented Next (3–5 Years) |

|---|---|---|

| Onboarding | Manual KYC, static checks | AI anomaly detection on docs + behavior bfsi.economictimes.indiatimes |

| Credit | CIBIL scores only | UPI/AA data ML models for 160M invisible users billcut |

| Collections | Fixed reminders, thresholds | Predictive delinquency via transaction graphs geekyants |

| Disputes | Manual ODR timelines | AI triage like UPI Help for real-time resolution paytm+1 |

Fraud scoring leads with NPCI’s pilots cutting scams via scam alerts; dispute triage automates via pilots like UPI Help.elitewealth+1

24-Month Roadmap for Mid-Size Fintech

Mid-size Indian fintechs can phase AI integration aligned with UPI/ONDC/AA.

- Months 1–6 (Foundation): Audit data from AA/UPI, pilot NPCI-like fraud scoring, set governance per India AI sutras. Build infra for real-time ML.blueflame+1

- Months 7–12 (Expansion): Deploy credit models on AA data, AI dispute triage for UPI/ONDC, test cross-sell prompts. Train teams, integrate Vertex AI chat.cloud.google+1

- Months 13–24 (Maturation): Scale agentic AI for collections, federated fraud with NPCI, personalize via behavioral graphs. Measure 30–50% fraud drop, 20% cross-sell uplift.aicerts+2

This roadmap delivers quick ROI via pilots, targeting MSME lending and UPI scale.linkedin

- https://bfsi.economictimes.indiatimes.com/news/fintech/how-npci-is-looking-combat-rising-upi-frauds-with-ai-tools/119961408

- https://cloud.google.com/customers/ondc

- https://sahamati.org.in/sahamati-labs-and-google-cloud-collaborate-to-shape-indias-financial-future-with-ai/

- https://www.medianama.com/2025/04/223-npci-ai-upi-fraud-detection/

- https://www.billcut.com/blogs/ai-credit-scores-beyond-cibil-and-experian/

- https://www.linkedin.com/pulse/use-ai-cross-selling-up-selling-banking-mohammad-arif-39mecent-dispute-resolution

- https://presolv360.com/resources/digital-dispute-resolution-decentralized-digital-commerce/