Singapore stands at the forefront of AI-driven risk modeling for SME lending across East Asia, revolutionizing access to capital through scalable, compliant models. While neighbors like Hong Kong, Japan, and South Korea advance in fintech, Singapore’s MAS-led frameworks ensure audit-ready AI that supports seamless cross-border operations. This positions the Lion City as the hub for SMEs navigating Asia’s $750 billion financing gap.mas+2

Singapore’s AI SME Lending Ecosystem

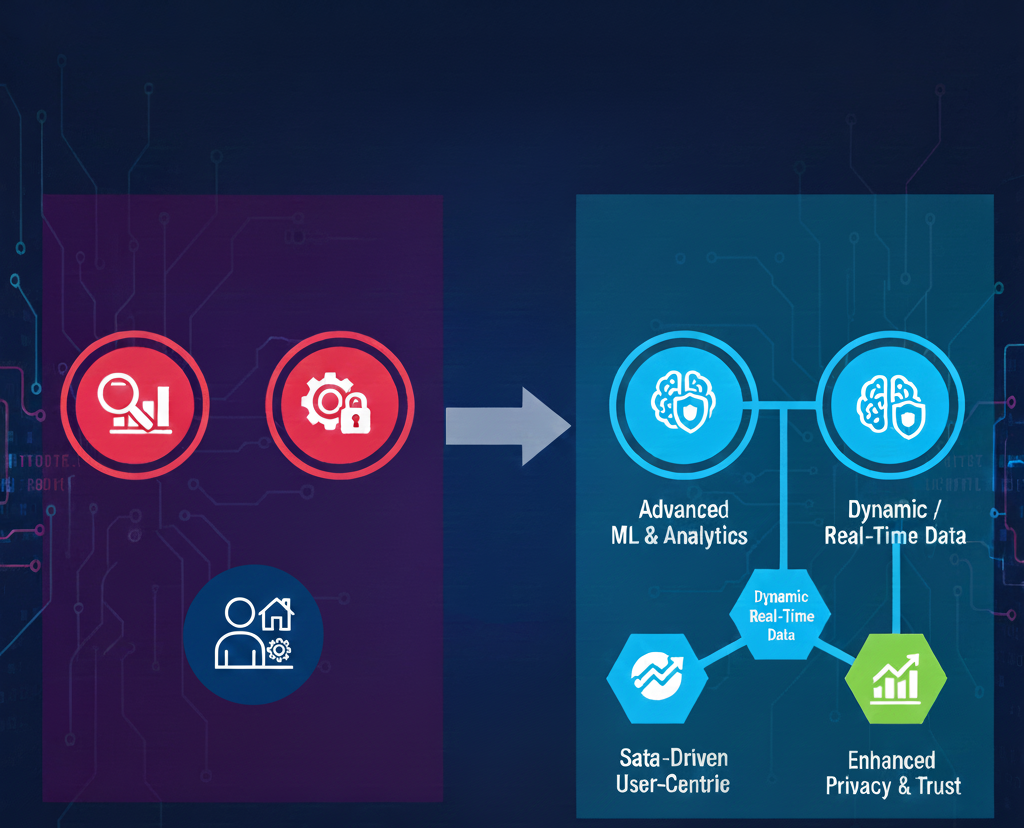

Fintechs such as finbots.ai and 6Estates exemplify Singapore’s edge, delivering AI credit scorecards that integrate alternative data like transaction histories and social proofs for SMEs lacking collateral. These platforms have secured major bank clients, transforming traditional underwriting from weeks to minutes. MAS’s AI/ML Model Risk Management principles enforce rigorous testing, including bias audits and scenario simulations, making models resilient to economic shocks.finbots+2

The AIDF (Agency for Innovation and Digital Finance) collaborates with startups to pilot fraud-integrated scoring, drawing on NUS research for hyper-local adaptations. This ecosystem benefits from Singapore’s 100% digital banking penetration and pro-innovation policies, fostering tools like agentic AI for dynamic risk updates.linkedin+1

East Asia Comparison: Singapore Pulls Ahead

Singapore’s balanced regulation contrasts with peers, enabling faster SME lending innovation.

| Country | AI Maturity in SME Risk | Regulatory Focus | SME Approval Gains |

|---|---|---|---|

| Singapore | Leader: Explainable ML + agents | MAS AIRM: Full lifecycle audits connectontech.bakermckenzie | 40–60% faster finbots |

| Hong Kong | Emerging: DBS human-AI hybrids | HKMA sandbox, data privacy theasianbanker | Trade-focused, 25% uplift |

| Japan | Steady: Predictive analytics | FSA conservative, silos iacpm | High accuracy, slow scale |

| South Korea | Widespread: KakaoBank ML | FSC AML emphasis ystats | Volume high, cross-border lag |

Japan’s data-hoarding culture hampers sharing, while Korea excels in payments but trails in SME-specific AI. Singapore’s MAS-FCA cross-border partnership accelerates pilots for ASEAN expansion.fintechfutures+1

Enabling Cross-Border Scalability

Singapore AI models excel in cross-border SME lending by standardizing data via APIs and blockchain oracles, integrating with platforms like Airwallex for real-time payments. For instance, finbots.ai’s models assess Cambodian exporters using Singapore trade data, reducing defaults 25% through federated learning. ONDC-inspired networks in ASEAN amplify this, with AI agents automating KYC across borders while complying with varying regs.finbots+2

Challenges like currency volatility are met with multi-currency stress tests, mandated by MAS for robustness. This unlocks $200B+ in untapped ASEAN SME trade finance.kpmg

Building Audit-Ready AI Infrastructure

MAS guidelines demand comprehensive AI inventories, from data ingestion to deployment, with board-level accountability and third-party audits via A.I. Verify. Models must demonstrate FEAT compliance, using techniques like SHAP for explainability, ensuring regulators trace decisions amid black-box risks. Fintechs conduct annual validations, far ahead of HK’s voluntary sandboxes or Japan’s nascent rules.rmaindia+2

This rigor builds trust, vital for institutional investors funding AI fintechs—Singapore captured 40% of SEA fintech funding in 2025.linkedin

Challenges and Mitigation Strategies

Data scarcity for SMEs persists; Singapore counters with synthetic data generation and partnerships like Validis for open banking feeds. Bias risks in diverse APAC demographics trigger ongoing monitoring, with MAS requiring human overrides for high-value loans. Cybersecurity threats prompt zero-trust AI pipelines.validis+1

24-Month Roadmap for Lenders

Adopt Singapore-style AI progressively:

- Months 1–6: Baseline audits, pilot MAS-compliant scorecards on local data.mas

- Months 7–12: Integrate cross-border APIs, test agentic fraud agents.digiqt

- Months 13–18: Scale to ASEAN via federated models, full FEAT certification.

- Months 19–24: Deploy genAI for personalized offers, measure 50% efficiency ROI.

By 2028, Singapore-led models will dominate, closing gaps via tokenized assets and quantum-safe encryption.fintechmagazine+1

- https://www.mas.gov.sg/publications/monographs-or-information-paper/2024/artificial-intelligence-model-risk-management

- https://rmaindia.org/monetary-authority-of-singapore-mas-guidelines-on-ai-risk-management/

- https://www.forbes.com/sites/rohitarora/2025/09/25/ai-is-transforming-small-business-finance-closing-global-funding-gap/

- https://www.finbots.ai/announcements/singapore-headquartered-ai-credit-modelling-fintech-finbots-ai-secures-a-leading-bank-client-in-brunei/

- https://www.linkedin.com/pulse/6estates-aidf-collaborate-advance-ai-driven-sme-credit-fraud-nt8pc

- https://www.finbots.ai/announcements/singapore-headquartered-ai-credit-modeling-fintech-finbots-ai-to-transform-credit-risk-management-for-cambodias-leading-commercial-bank-sathapana-bank/

- https://digiqt.com/blog/ai-agents-for-sme-lending/

- https://connectontech.bakermckenzie.com/singapore-mas-publishes-consultation-paper-on-proposed-guidelines-on-ai-risk-management-for-financial-institutions/

- https://www.theasianbanker.com/updates-and-articles/dbs-hong-kong-drives-digital-leap-for-smes-with-human-centred-ai