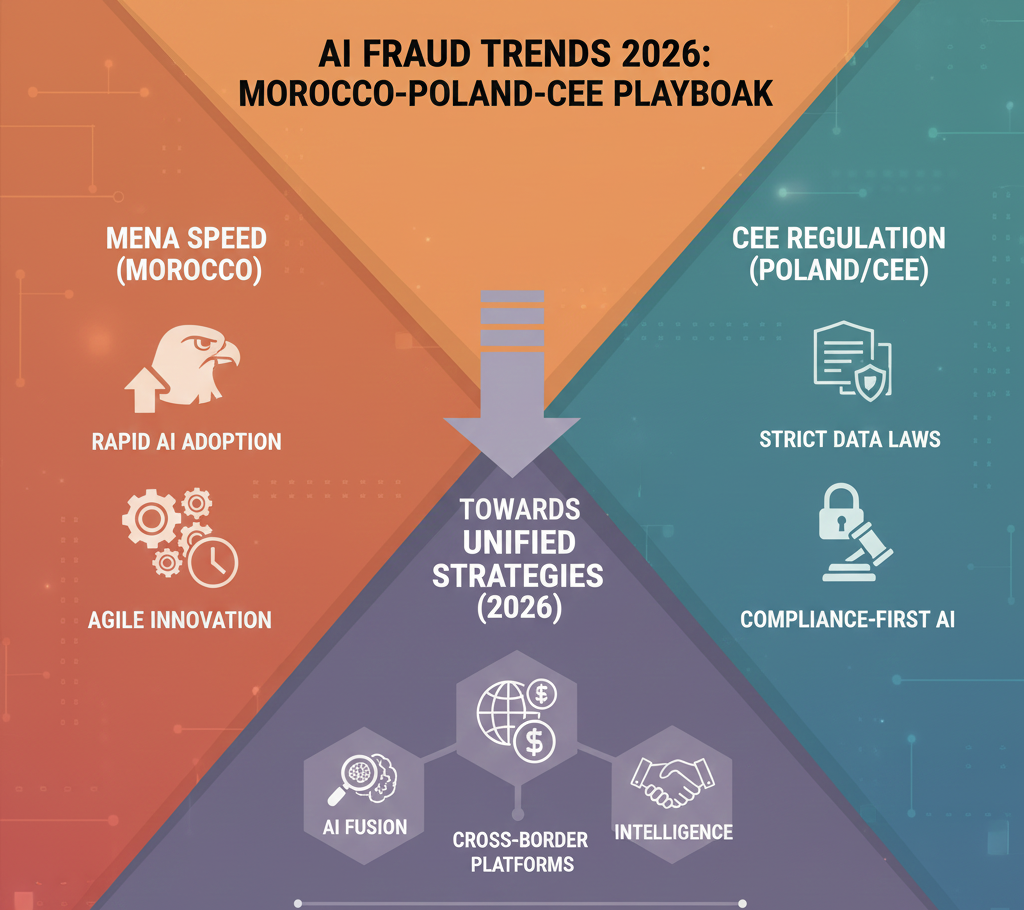

AI-powered fraud surges in 2026 with deepfakes, agentic scams, and synthetic identities dominating threats across Morocco, Poland, and CEE. MENA regions like Morocco prioritize rapid AI deployment amid digital payment booms, while CEE’s EU-aligned regs emphasize compliance-heavy defenses. Unified strategies blending behavioral AI and regs offer a playbook for cross-regional resilience.niceactimize+2

2026 Global AI Fraud Landscape

Fraudsters wield generative AI for hyper-realistic phishing, voice cloning, and adaptive agents, industrializing attacks at scale. Identity fraud turns AI-native, with synthetic “full life” profiles evading KYC via telemetry spoofing. Expect 17–50% rises in scams, driven by deepfakes in e-commerce and banking.feedzai+2

MENA Speed: Morocco’s Agile Response

Morocco’s fintech boom—fueled by mobile money like Wafa Cash—faces explosive fraud growth, mirroring UAE/Saudi trends with AI deepfakes and linguistic mimicry in Arabic scams. MENA leads adoption speed, with GCC AI detection markets hitting $1.2B by 2030 via real-time ML. Morocco regulators push cloud AI for anomaly detection, outpacing CEE in deployment but lagging data privacy.it-online+2

CEE Regulation: Poland’s Structured Approach

Poland enforces PSD2, GDPR, and AML via PFSA/GIFI, mandating transaction monitoring and public warnings for parabanks. CEE focuses on SCA to curb APP fraud, with MiCAR regulating crypto-AI risks; new EU AML Authority tightens practices. Poland’s regtech thrives on robust AML but slows AI experimentation versus MENA’s agility.practiceguides.chambers+1

Speed vs Regulation Comparison

MENA’s fast AI wins contrast CEE’s compliance focus.

| Aspect | MENA (Morocco-like) | CEE (Poland-like) |

|---|---|---|

| Adoption Speed | Rapid; genAI pilots rampant it-online | Measured; EU sandbox required trade |

| Key Threats | Deepfakes, AI slop in Arabic conflictadvisory | APP, crypto-AML practiceguides.chambers |

| Regulation | Flexible, cybersecurity-driven | Strict GDPR/AML audits practiceguides.chambers |

| Fraud Rise 2026 | 50%+ in digital payments kenresearch | 9–17% identity fraud fintech-intel |

CEE’s frameworks reduce false negatives but increase costs; MENA risks bias without audits.kenresearch+1

Unified Fraud Playbook

Blend MENA speed with CEE regs for resilient strategies:

- Layered AI Defenses: Behavioral analytics + genAI liveness checks; adaptive ML for agents.datawalk+1

- Cross-Border Intel: Share via EU AMLA or MENA forums; federated learning avoids data silos.practiceguides.chambers

- Human-AI Hybrid: Train “human firewalls” for deepfake spotting; automate low-risk rules.webasha+1

- Regtech Integration: PSD2 APIs for real-time monitoring; synthetic data for training.trade+1

Morocco-Poland Roadmap

- Q1 2026: Audit pipelines, pilot MENA-style cloud AI in Poland-compliant sandboxes.niceactimize

- Q2-Q3: Deploy unified agents for deepfake/APP; integrate GIFI warnings.practiceguides.chambers

- Q4: Scale cross-regional sharing; target 40% false positive cuts.webasha

This playbook counters 2026 convergence, securing Morocco’s growth and Poland’s stability.aiworldjournal+1

- https://www.niceactimize.com/blog/fraud-in-2026-preparing-for-convergence

- https://it-online.co.za/2025/12/30/ai-set-to-dominate-in-2026/

- https://aiworldjournal.com/ai-fraud-agents-identity-fraud-report-2025-2026/

- https://www.feedzai.com/resource/predictions-for-2026-scams-ai-and-fintech/

- https://fintech-intel.com/ai/why-2026-must-be-the-year-ai-powered-fraud-is-taken-seriously/

- https://conflictadvisory.com/news/the-invisible-predator-how-ai-is-redefining-digital-fraud-in-the-uae

- https://www.kenresearch.com/gcc-ai-fraud-detection-solutions-market

- https://practiceguides.chambers.com/practice-guides/financial-services-regulation-2025/poland/trends-and-developments/O23117