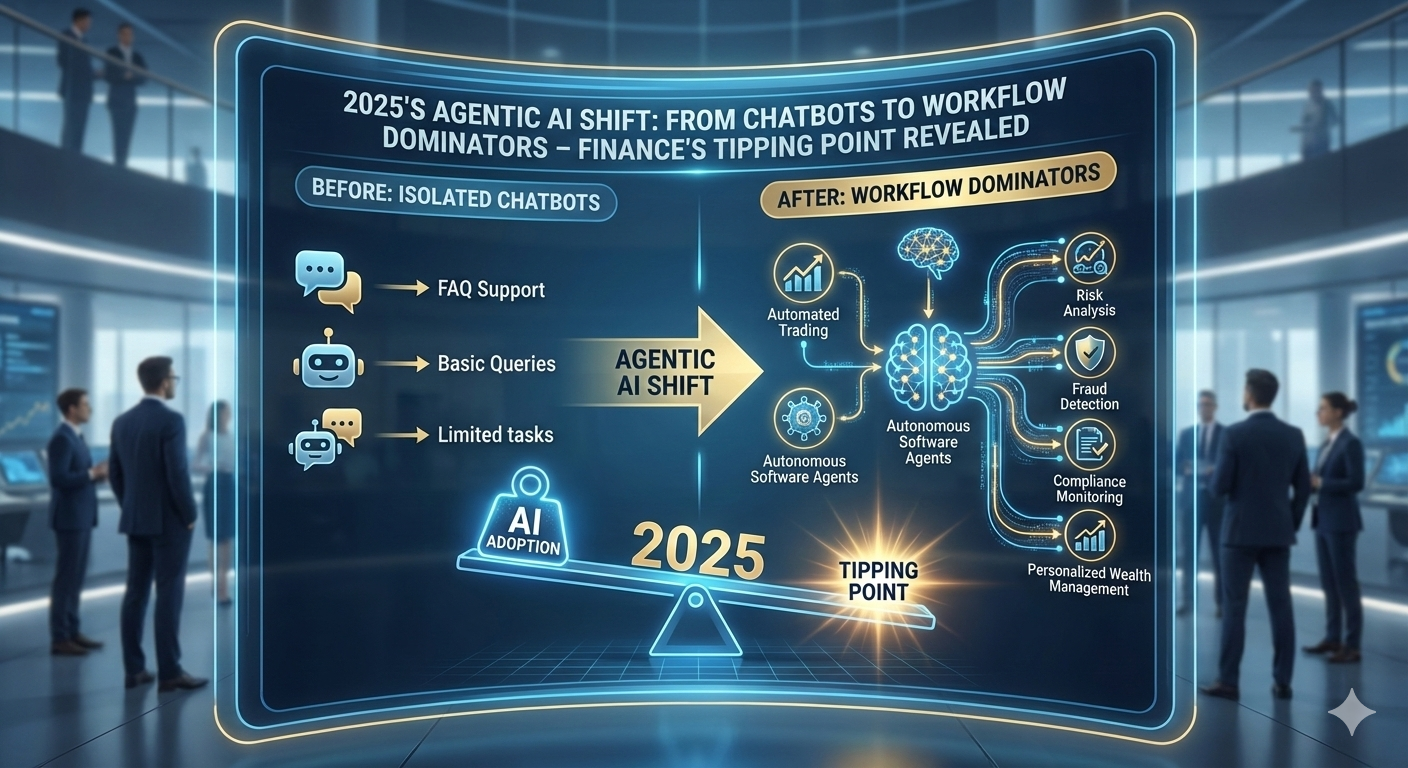

For a decade, financial institutions talked about AI as a way to make chatbots friendlier and analytics dashboards smarter. In 2025, that conversation changed. A new class of agentic AI moved from answering questions to running workflows — autonomously coordinating tasks, calling APIs, and executing decisions across complex financial operations.

This shift is emerging as a genuine tipping point: not because the technology suddenly appeared, but because regulators, cloud providers, and large banks all started aligning around autonomous, governed AI systems as a core part of future operating models.[2][3][4]

From Static Chatbots to Agentic AI

Traditional AI in finance was largely assistive: models scored credit risk, flagged fraud, or powered chatbots that handed off to humans for anything complex. By contrast, agentic AI systems are designed to:

- Reason over structured and unstructured data to understand context and constraints[1]

- Plan multi-step workflows across systems and teams[1][2]

- Decide in real time, aligned with policies, risk limits, and regulations[1]

- Execute actions — updating records, triggering payments, routing cases, or generating filings[1][2]

Instead of a chatbot suggesting the next step in a mortgage application, an AI agent can now orchestrate the entire process: ingest documents, verify incomes, check policy rules, request missing data, and surface only edge cases to a human underwriter.[1][2]

Why 2025 Became Finance’s Agentic Tipping Point

Several developments in the past year turned agentic AI from a slideware concept into a board-level execution priority:

- Industry recognition of “from chat to action”. Gartner named agentic AI a top strategic trend for 2025, highlighting a shift from conversational interfaces to systems that drive business outcomes by 2026.[4]

- Cloud platforms industrialised agents. AWS introduced agentic solutions for financial services, including Bedrock AgentCore to build and manage autonomous AI agents for complex workflows such as loan processing and compliance monitoring.[2] Microsoft similarly framed 2025 as the start of the “agentic business applications” era, with AI-first workflows embedded directly into core systems.

- Investment and experimentation surged. A September 2025 report from FinRegLab noted that venture funding into agentic applications grew roughly 150% year over year, with finance among the prime target sectors.[3] The report documents pilots ranging from real-time portfolio agents to autonomous deposit sweep tools that continuously manage FDIC insurance limits.[3]

- Enterprise leaders reframed AI as a workflow issue. A Deloitte tech trends analysis emphasizes that many organizations are preparing for a “silicon-based workforce” where AI agents take on end-to-end processes, not isolated tasks — but also highlights that data searchability (48%) and reusability (47%) remain key obstacles.[6]

Put together, 2025 is not just another year of AI experimentation. It is the year major banks, regulators, and cloud platforms began converging on agentic operating models as the next stage of digitisation.

Where Agentic AI Is Quietly Taking Over Financial Workflows

1. Credit, Lending, and Underwriting

Lending has long been constrained by manual document review, siloed data, and inconsistent application of policy. Agentic AI restructures this into a coordinated decision flow:[1]

- Document agents extract income, liabilities, collateral values, and terms from bank statements, payslips, and appraisals[1]

- Decision agents apply credit policies, pricing logic, and risk thresholds in real time[1]

- Database agents fetch internal histories, external bureau data, and market signals[1]

- Unstructured agents ground edge cases in prior decisions or policy memos[1]

Early deployments report major cycle-time gains. One industry analysis notes that AI-driven underwriting can cut loan processing times by up to 70% and improve credit risk accuracy for a majority of lenders adopting such workflows.[1] That improvement is not about a smarter score alone; it is about agents coordinating the entire underwriting journey, including exception routing and audit-trail creation.

2. Real-Time Risk, Fraud, and Compliance Orchestration

Traditional fraud and compliance controls rely on rules engines and post-event reviews, which struggle to keep pace with new attack patterns and shifting regulatory expectations. Agentic AI supports continuous risk execution:[1]

- Agents evaluate transactions against dynamic risk and fraud scenarios, not just static rules

- Unstructured agents interpret evolving regulatory guidance, aligning decisions with new expectations in near real time[1][3]

- Document agents validate KYC/AML documentation and automatically assemble evidence for audits[1]

Strategy firms such as BCG highlight how AI agents are beginning to autonomously detect anomalies, forecast cash needs, and recommend reallocations across treasury portfolios — effectively becoming always-on risk sentinels embedded into core finance platforms.

3. Autonomous Finance for Consumers and SMEs

On the client side, 2025 saw growing interest in what some call autonomous finance — agents that manage money on a user’s behalf. AWS cites use cases where AI agents continuously monitor portfolios, proactively refinance mortgages when rates fall, or negotiate insurance premiums based on changing customer profiles.[2]

A FinRegLab study describes the next wave of “financial agents” that can go beyond robo-advice: not just suggesting savings or reallocations, but executing transfers, adjusting investment strategies, or reallocating deposits across banks to remain within insurance limits.[3] These agents sit between households or SMEs and a fragmented financial landscape, interfacing programmatically with multiple institutions.

4. Internal Financial Operations and the Back Office

Agentic AI is also quietly overturning how finance functions run internally. Executives interviewed in the AWS–Forrester research expect agents to augment or replace parts of existing RPA estates, handling tasks that require context and judgment, not just screen-scraping.[2] Examples include:

- Dynamic liquidity management: agents forecasting cash needs and automatically triggering internal transfers or funding actions

- Continuous forecasting: agents coordinating real-time data ingestion and scenario testing, updating financial plans as conditions shift[1]

- Dispute management: agents collecting case data, proposing resolutions, and drafting communication for human approval[2]

Microsoft’s recent announcements around “agentic business applications” show this trend moving into mainstream ERP and CRM stacks, where agents become first-class actors alongside human users and automated workflows.

The Infrastructure and Governance Challenge

Despite the momentum, adopting agentic AI at scale is far from plug-and-play. Recent analyses converge on three major obstacles:

- Data foundations. Deloitte’s 2025 survey found nearly half of organizations struggle with data searchability (48%) and reusability (47%), undermining agents that rely on accurate retrieval and context.[6] Without robust data catalogs, lineage, and access controls, agents either overfit to narrow data slices or risk amplifying data quality issues.

- Trust, safety, and oversight. The World Economic Forum highlights infrastructure, trust, and data as the three obstacles holding back agentic AI, warning that poor guardrails can lead to compliance breaches or opaque decision paths. Financial institutions are now piloting supervision frameworks that combine policy-aligned prompts, fine-grained permissions, and human-in-the-loop checkpoints for high-risk actions.[1][3]

- Organizational readiness. As Fortune’s late-2025 coverage notes, early adopters like Capital One are seeing positive results from AI agents but emphasize that realizing value requires process re-engineering, new talent, and patience — not just dropping agents into legacy workflows.[5]

In short, 2025 proved that agentic AI can work. The remaining question is whether institutions can update their operating models — governance, incentives, architecture — quickly enough to harness it safely.

How Leading Financial Institutions Are Responding

The institutions that made the most progress in 2025 typically adopted a few common patterns:[1][2][3]

- Start with bounded, high-friction workflows such as underwriting, KYC refresh, or reconciliations — processes with clear policies, heavy manual workload, and measurable KPIs.

- Compose agents, don’t overbuild one “super agent”. Successful programs separate document, decision, retrieval, and conversational agents that collaborate within a governed workflow platform.[1][2]

- Embed auditability by design with detailed action logs, confidence scores, and rationales suitable for internal model risk management and external regulators.[1][3]

- Define human-in-the-loop tiers where agents can act autonomously within preset bounds but must escalate beyond certain thresholds (e.g., credit exposure, anomalous behavior, or regulatory uncertainty).

By treating agentic AI as a new class of workforce — with roles, permissions, and escalation paths — rather than a generic feature, these organizations are laying the groundwork for broader deployment across finance, risk, and customer channels.

What 2026 Could Look Like If 2025 Was the Tipping Point

Looking ahead, several trends are likely to accelerate if 2025’s momentum continues:

- From pilots to platform commitments. As Microsoft, AWS, and other major platforms deepen their agent frameworks, financial institutions may increasingly standardize on agentic architecture as the default for new workflows.[2]

- Regulator-led experimentation. Bodies and think tanks like FinRegLab are already scrutinizing agentic AI’s impact on fairness, transparency, and stability.[3] Expect more sandboxes, guidance, and possibly dedicated rules for autonomous agents operating in regulated domains.

- Consumer-facing “personal financial agents”. As trust frameworks mature, more banks and fintechs are likely to offer agents that actively manage bills, savings, and investments across providers — effectively becoming the operating system for household finances.[2][3]

Conclusion

2025 will be remembered in finance not just as another year of AI hype, but as the moment when agentic AI stepped out of the chatbot and into the workflow. From underwriting and fraud monitoring to autonomous finance and internal operations, agents are beginning to act as a programmable layer of execution across the balance sheet.

The opportunity is enormous, but so is the responsibility. Institutions that treat agentic AI as a strategic shift in how work gets done — investing in data foundations, governance, and human–agent collaboration — are best placed to turn this tipping point into durable advantage.

Those that don’t may soon discover that in finance’s next chapter, the real competition is no longer whose chatbot sounds more human, but whose agents can most safely and effectively run the work.

References

- https://www.multimodal.dev/post/how-to-use-agentic-ai-in-finance

- https://aws.amazon.com/blogs/awsmarketplace/agentic-ai-solutions-in-financial-services/

- https://finreglab.org/wp-content/uploads/2025/09/FinRegLab_09-04-2025_The-Next-Wave-Arrives-Main.pdf

- https://www.salesforce.com/blog/how-agentic-ai-will-save-financial-services/

- https://fortune.com/2025/12/15/agentic-artificial-intelligence-automation-capital-one/

- https://www.deloitte.com/us/en/insights/topics/technology-management/tech-trends/2026/agentic-ai-strategy.html