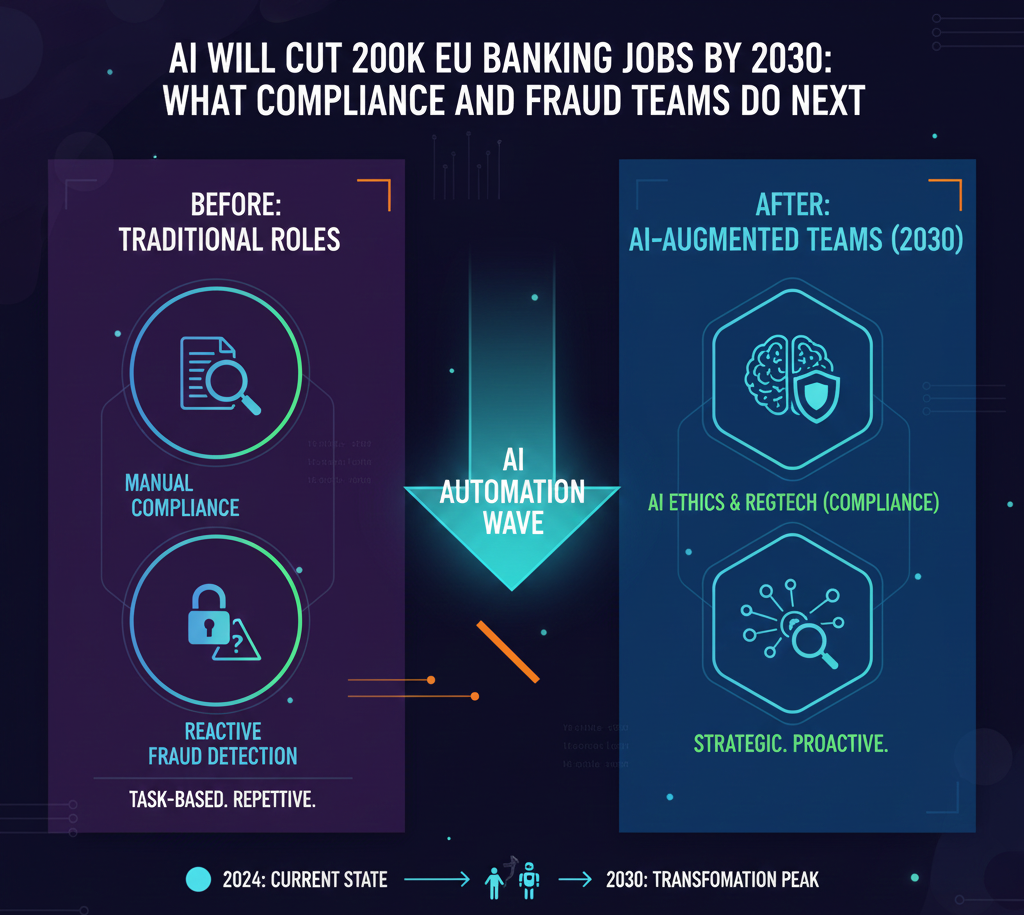

Analysts at Morgan Stanley predict that artificial intelligence will displace around 200,000 jobs in European banking by 2030, primarily targeting back and middle office roles including compliance and fraud detection.[1] This forecast, equating to about 10% of the sector’s workforce, signals a profound shift as banks prioritize AI for efficiency gains amid competitive pressures.

The Scale of AI-Driven Disruption in EU Banking

European banks face a stark reality: AI automation is reshaping operations, with the most vulnerable positions concentrated in central services. Back office roles—handling data processing, transaction support, and basic compliance checks—are prime for replacement by algorithms that process vast datasets faster and with fewer errors than humans.[1] Middle office functions, such as risk management and financial reporting, will also see significant streamlining through AI’s superior analytical capabilities.

The 200,000 job figure underscores the urgency. As banks cut operational costs, AI promises not just displacement but enhanced productivity. For instance, routine fraud monitoring, which involves sifting through millions of transactions daily, can now be handled by machine learning models trained to detect anomalies in real-time—tasks that once required teams of analysts.

Why Compliance and Fraud Teams Are in the Crosshairs

Compliance teams ensure adherence to evolving regulations like GDPR, AML (anti-money laundering), and PSD2, often through manual reviews of customer data and transaction logs. AI excels here by automating KYC (know your customer) processes, flagging suspicious patterns with 95%+ accuracy in some systems. Fraud teams, meanwhile, battle sophisticated schemes like phishing and account takeovers; AI-powered tools analyze behavioral biometrics and transaction velocities to preempt threats, reducing false positives that bog down human reviewers.

Consider a practical example: A major EU bank using AI for fraud detection reduced investigation times from days to minutes, per industry benchmarks. Yet, this efficiency comes at a cost—entry-level analysts and verifiers face obsolescence, while senior roles evolve into oversight positions.

Strategies for Compliance Teams to Thrive

Compliance professionals must pivot from rote checking to strategic oversight. Key actions include:

- Master AI Tools: Learn platforms like IBM Watson or custom ML models for regulatory reporting. Certifications in AI ethics and regtech (regulatory technology) are booming.

- Focus on Human Judgment: AI struggles with nuanced interpretations, such as cultural contexts in cross-border compliance. Teams should specialize in auditing AI outputs and handling edge cases.

- Upskill in Data Governance: With AI reliant on quality data, experts in data lineage and bias mitigation will be indispensable.

Banks investing in reskilling report 30-50% retention rates for upskilled staff, turning potential layoffs into internal promotions.

Fraud Teams’ Path Forward: Augment, Don’t Replace

Fraud detection is evolving into a hybrid model where AI handles volume, and humans tackle complexity. Fraud specialists should:

- Adopt Advanced Analytics: Train on graph neural networks that map fraud rings across networks, beyond simple rule-based systems.

- Leverage Behavioral AI: Combine AI with human intuition for high-stakes cases, like executive impersonation scams.

- Build Cross-Functional Expertise: Partner with cybersecurity and data science teams to design resilient systems against AI-generated deepfakes.

Examples abound: HSBC’s AI fraud engine processes 1.2 billion transactions monthly, yet retains investigators for adversarial threats where AI lags.

The Upskilling Imperative and Industry Response

Banks, regulators, and governments must collaborate on transitions. Morgan Stanley emphasizes retraining in digital literacy and technical skills.[1] EU initiatives like the Digital Europe Programme fund AI literacy programs, targeting 1 million specialists by 2030. Educational partners offer bootcamps in Python for finance, AI governance, and ethical hacking.

Forward-thinking banks are creating ‘AI centers of excellence’ where compliance and fraud staff prototype tools, fostering innovation while securing jobs. The message is clear: Adaptation beats automation.

Broader Economic Implications

Beyond jobs, this shift promises economic stability through cost savings reinvested in growth areas like sustainable finance. However, without proactive measures, regional disparities could widen—peripheral EU nations lag in AI adoption, risking higher unemployment.

Stakeholders must prioritize inclusive training to harness AI’s benefits equitably.

Conclusion

AI’s projected cut of 200,000 EU banking jobs by 2030 is a call to action for compliance and fraud teams: embrace augmentation through upskilling, focus on irreplaceable human strengths, and drive innovation. By doing so, they can transform disruption into opportunity, ensuring a resilient sector.