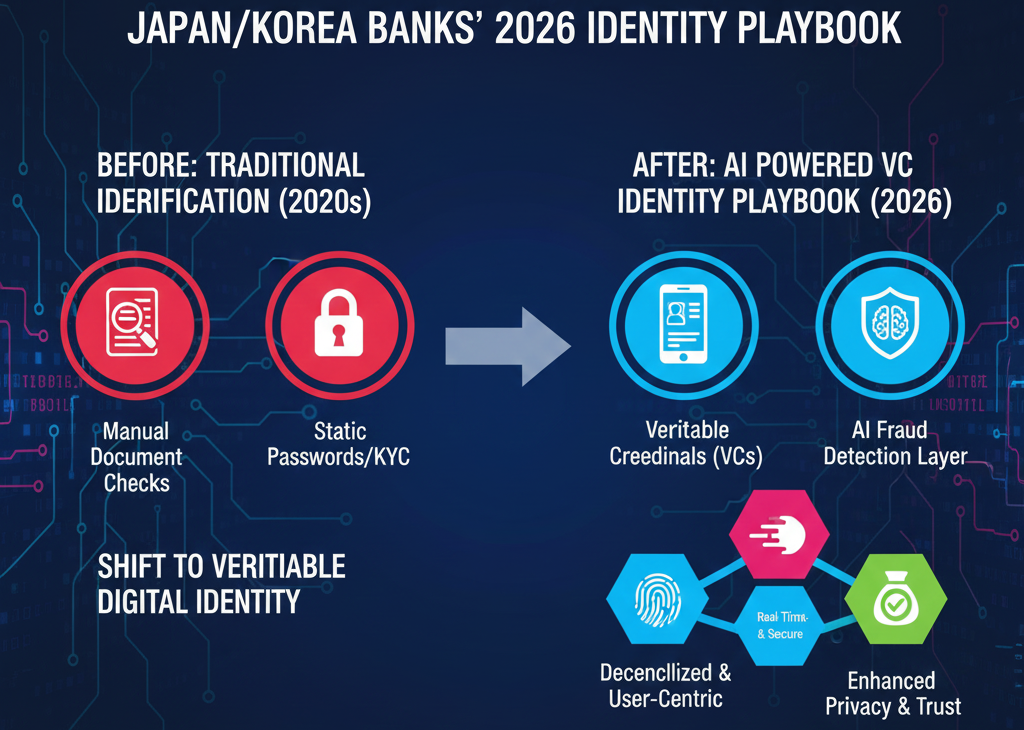

Verifiable Credentials vs AI Fraud: Japan and Korea Banks’ 2026 Identity Playbook

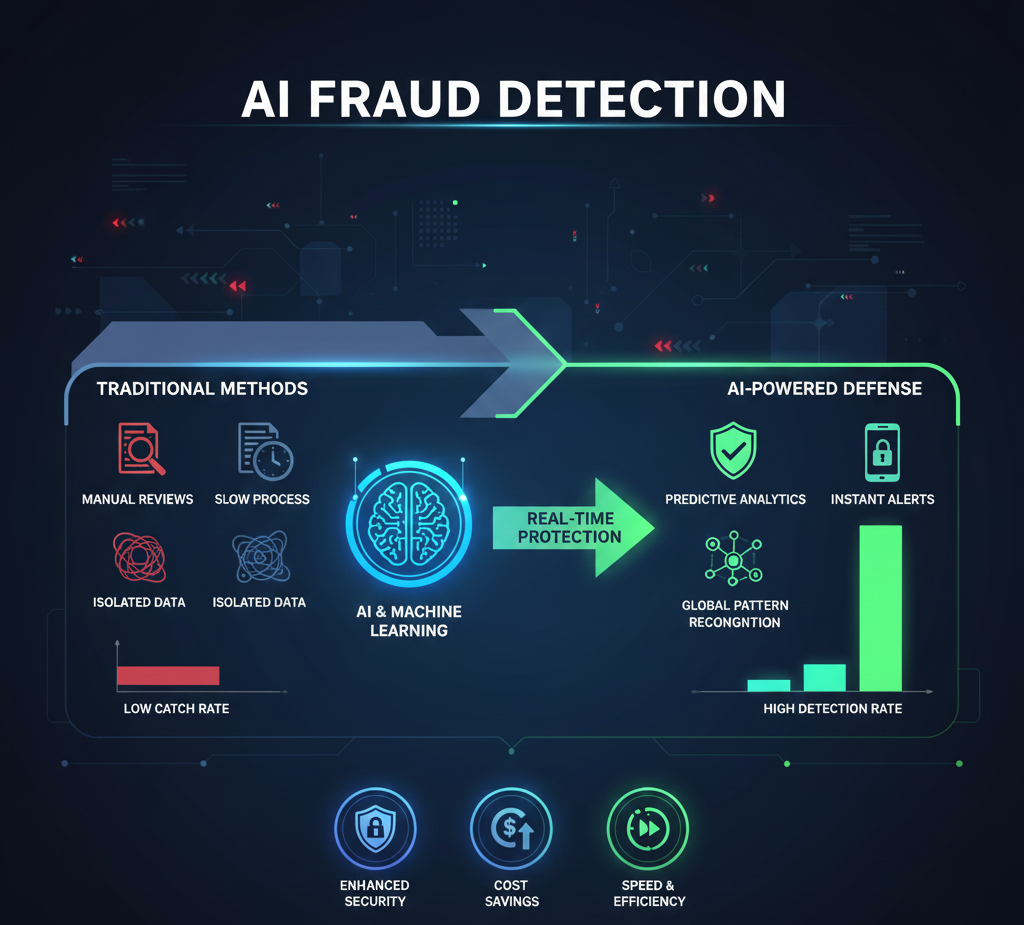

As artificial intelligence continues to evolve, so do the threats it poses to financial institutions. Identity fraud powered by AI has become increasingly sophisticated, leaving traditional authentication methods vulnerable. In response, banks across Asia-Pacific—particularly in Japan and South Korea—are embracing a transformative approach: verifiable credentials (VCs) and phishing-resistant authentication technologies. This strategic shift represents a … Read more