The Bank of Japan stands at a critical crossroads. After maintaining interest rates at 0.5% for months, internal policy discussions and recent statements from Governor Kazuo Ueda suggest that a significant monetary policy shift could arrive as early as December 2025. This potential rate increase represents far more than a routine adjustment to Japan’s borrowing costs—it signals a fundamental recalibration of one of the world’s largest economies and carries profound implications for global financial markets, currency valuations, and investor portfolios worldwide.

As the December 18-19 policy meeting approaches, market participants, economists, and policymakers are closely monitoring signals from Tokyo. The stakes are extraordinarily high, and the timing couldn’t be more delicate given ongoing global economic uncertainties, trade tensions, and inflation pressures.

The Current State of Play: What the BOJ Is Signaling

During the Bank of Japan’s October 30 policy meeting, the nine-member board voted 7-2 to maintain the current policy rate at 0.5%[1]. However, the dissenting votes and accompanying policy discussion minutes reveal a central bank increasingly convinced that conditions for monetary policy normalization are approaching maturity. One board member stated that “it is likely that conditions for taking a further step toward the normalization of the policy interest rate have almost been met,” while emphasizing the need to monitor underlying inflation trends[2].

This language represents a significant shift in tone from the BOJ’s traditionally cautious stance. The fact that two board members actively dissented, calling for a 25 basis point hike, underscores growing internal pressure to act. Hajime Takata and Naoki Tamura, the dissenting members, argued that inflation is approaching the Bank’s 2% target and that the policy rate should move closer to neutral levels[3].

Governor Kazuo Ueda’s recent communications have further fueled speculation about imminent action. While his public remarks have been carefully measured to avoid premature market expectations, his underlying message is unmistakable: the BOJ is preparing for a policy shift in the coming months. Market analysts now anticipate a rate increase by January 2026 at the latest, with the December meeting representing the primary flashpoint[1].

The Economic Backdrop: Why Now?

Understanding the BOJ’s potential pivot requires examining the economic conditions that have prompted this reassessment. Japan’s economic performance has shown surprising resilience despite global headwinds. The BOJ revised its full-year 2025 GDP outlook upward from 0.6% to 0.7%, reflecting stronger-than-expected growth in the second quarter[3]. While third-quarter GDP is expected to contract due to the unwinding of front-loaded exports, analysts anticipate a gradual recovery in subsequent quarters.

More critically, inflation has remained stubbornly elevated. The core-core inflation rate is expected to slow but remain above 2% for the next three years. The BOJ’s full-year 2025 inflation forecast stands at 2.8%, while the fiscal year 2026 outlook was revised upward to 2.0% from the previous 1.9% estimate[3]. This persistent inflation, supported by strong wage growth and elevated USD/JPY exchange rates, has created mounting pressure on policymakers to normalize monetary conditions.

Eiji Maeda, a former BOJ executive director who oversaw monetary policy drafting until May 2020, has articulated the case for action with particular clarity. He argues that the BOJ “may already be somewhat behind the curve in addressing inflationary risks, which is causing some distortions in the economy,” including soaring property prices in major cities and a weak yen that is driving up households’ cost of living[4]. Maeda expects Japan’s economy to continue expanding moderately, as the impact of U.S. tariffs has proven smaller than initially feared, and companies are maintaining upbeat capital expenditure and wage hike plans.

The December Decision: Timing and Implications

The BOJ’s December 18-19 policy meeting will likely prove decisive. According to Maeda’s analysis, by December the central bank will have access to critical data points that could justify action: the results of Japan’s “tankan” business survey in early December, additional information on U.S. economic conditions, and early signals from major automakers regarding next year’s wage plans[4]. These data inputs could provide the BOJ with sufficient confidence to finally move forward with a rate increase.

If the BOJ does proceed with a hike in December, the most likely scenario involves raising the policy rate to 0.75%[4]. This would represent the first increase since January 2025, when the BOJ raised rates from near-zero levels to 0.5% as it concluded its decade-long stimulus program. The trajectory beyond December also appears increasingly clear: analysts expect another rate increase around summer 2026 to bring the policy rate to 1%, which falls within the BOJ’s estimated 1% to 2.5% neutral rate range[4].

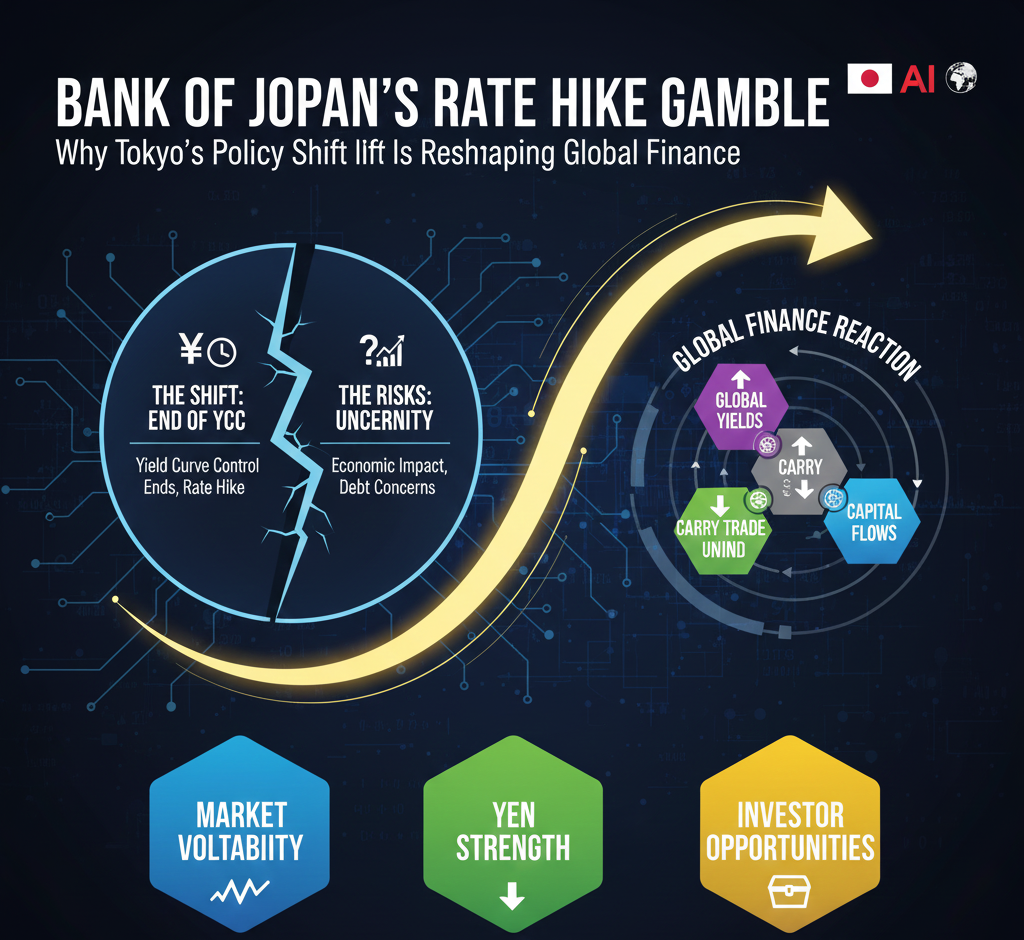

Global Ramifications: Why the World Should Pay Attention

Japan’s monetary policy decisions reverberate far beyond Tokyo’s financial district. A BOJ rate hike would trigger significant shifts in global currency markets, with the yen likely strengthening against major currencies including the U.S. dollar. This currency appreciation would have immediate consequences for Japanese exporters, potentially dampening their international competitiveness, while simultaneously making imports more expensive for Japanese consumers.

The carry trade—a popular investment strategy where traders borrow in low-yielding Japanese yen to invest in higher-yielding assets elsewhere—would face increased headwinds. Higher Japanese rates reduce the appeal of this strategy, potentially forcing unwinding of positions and creating volatility across global asset markets. Investors holding significant yen-denominated debt or currency positions would face meaningful adjustments.

Furthermore, a BOJ rate increase signals that even the world’s most dovish major central bank is shifting toward normalization. This development could influence expectations about monetary policy trajectories globally and potentially support higher interest rates across developed economies. For emerging markets and developing nations, this environment could mean reduced capital inflows and higher borrowing costs.

The Uncertainty Factor: Why the BOJ Is Moving Cautiously

Despite growing internal conviction that rate normalization is warranted, the BOJ remains acutely aware of significant uncertainties. Global trade policy remains volatile, with U.S. tariff threats creating unpredictable headwinds for export-dependent economies like Japan. The BOJ’s assessment explicitly emphasizes this uncertainty, noting that trade policy impacts continue to cloud the economic outlook[3].

Additionally, while inflation has remained above target, the BOJ must carefully calibrate its approach to avoid derailing economic growth. Japan’s economy, while showing resilience, remains vulnerable to external shocks. Moving too aggressively on rates could inadvertently trigger a slowdown that would undermine the wage growth and inflation dynamics that have supported the case for normalization.

This balancing act explains why Governor Ueda has maintained deliberately dovish public rhetoric even as internal policy discussions point toward action. The BOJ is essentially preparing markets for a rate hike while maintaining flexibility to adjust course if economic conditions deteriorate unexpectedly.

What Investors Should Expect

For investors and market participants, the BOJ’s December decision will likely trigger immediate market reactions across multiple asset classes. Currency markets will respond sharply to any rate increase announcement. Equity markets, particularly Japanese exporters, may face near-term pressure from yen appreciation concerns. Bond markets will reprice Japanese government securities, potentially extending the yield curve.

The BOJ’s forward guidance will prove equally important as the decision itself. Policymakers will need to communicate clearly about the expected pace of future rate increases to manage market expectations and avoid creating unnecessary volatility. A measured, gradual approach to normalization—increasing rates incrementally while carefully monitoring economic responses—appears most likely.

Conclusion: A Watershed Moment for Global Finance

The Bank of Japan’s anticipated rate hike represents a watershed moment in global monetary policy. For nearly a decade, the BOJ has been the world’s most accommodative major central bank, maintaining deeply negative real rates and massive stimulus programs. A shift toward normalization, even if gradual and measured, signals that the era of extraordinary monetary accommodation is definitively ending.

This transition carries profound implications for asset valuations, currency markets, capital flows, and economic growth trajectories worldwide. Investors, policymakers, and economists must carefully monitor the BOJ’s December decision and the policy guidance that accompanies it. The stakes extend far beyond Japan’s borders—Tokyo’s monetary policy gamble will help reshape the global financial landscape for years to come.

References

- https://phemex.com/news/article/bank-of-japan-signals-possible-rate-hike-by-december-34293

- https://www.indexbox.io/blog/bank-of-japan-signals-potential-december-interest-rate-hike/

- https://www.fxstreet.com/amp/analysis/bank-of-japan-holds-rates-with-two-dissenting-votes-december-hike-still-possible-202510301251

- https://whbl.com/2025/10/22/boj-likely-to-raise-rates-as-soon-as-december-ex-central-bank-executive-says/