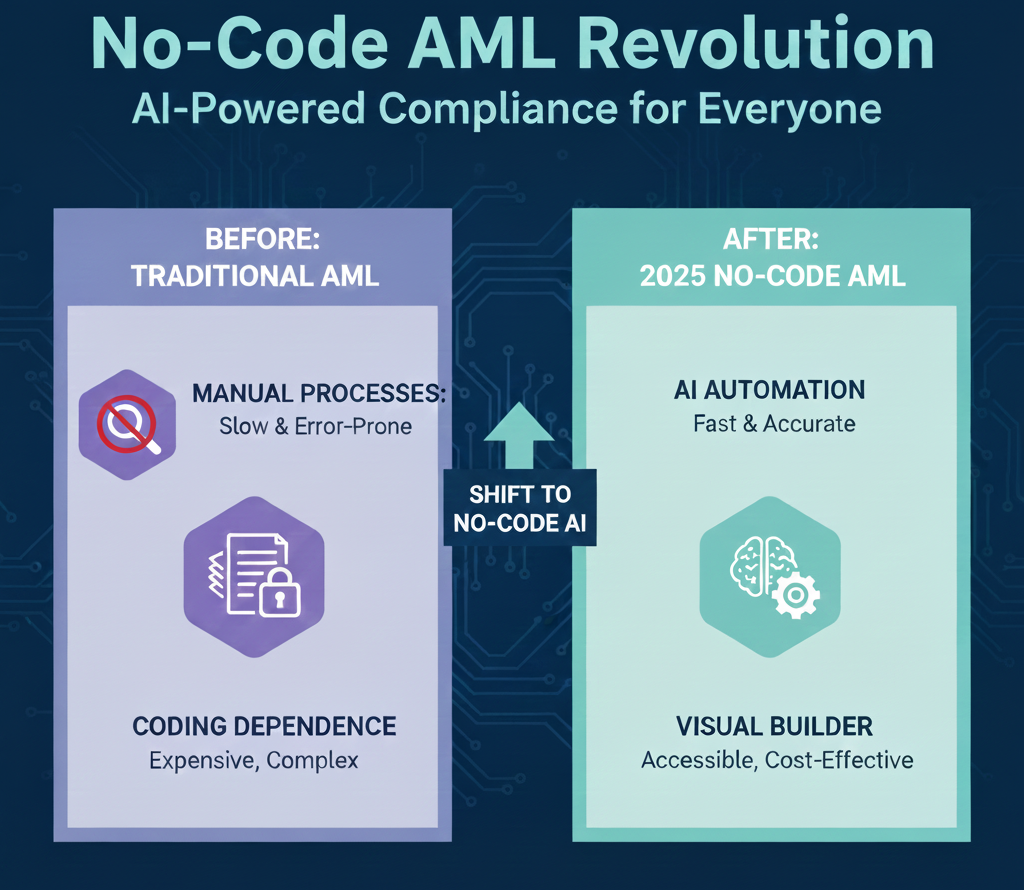

No-code platforms are transforming anti-money laundering (AML) compliance, allowing fintechs to build and configure sophisticated systems rapidly without traditional coding expertise. This shift enables fintechs to bypass banks’ slower, IT-heavy processes, gaining a competitive edge in the 2026 compliance landscape.[1][4]

The Rising Pressure of AML Compliance in Fintech

Fintechs prioritize innovation and customer experience but face mounting AML and fraud detection demands. Fast-growing fintechs must screen payments, monitor transactions, and rate customer risk while keeping teams lean. Traditional bank systems, reliant on large IT departments, struggle with agility amid evolving regulations.[4][5]

No-code AML solutions address this by offering configurable workflows for typologies, rules, and screenings. For instance, platforms provide no-code configuration managers for AML transaction monitoring, payment screening, and customer risk rating, reducing false positives by up to 70% through AI.[4]

What Are No-Code AML Platforms?

No-code AML platforms empower non-technical users to design compliance workflows visually. These tools include drag-and-drop interfaces for KYC, AML monitoring, fraud detection, and risk scoring. Fintechs use them to integrate with core banking, credit bureaus, and payment gateways via API-first architectures.[2][3]

Key features include:

- Built-in compliance frameworks for quick updates to KYC and AML rules.

- Audit trails and access controls for regulatory audits.

- AI-driven false positive reduction and 360° customer views.

- Scalable, cloud-native designs for high-volume transactions.

Unlike custom-coded systems, no-code platforms cut development time from months to weeks, minimizing IT bottlenecks.[3][5]

Why Fintechs Are Leading the No-Code Charge

Fintechs adopt no-code AML faster than banks due to their digital-native agility. Banks often depend on legacy infrastructure, requiring vendor involvement for changes. Fintechs, targeting niches like gig workers or BNPL, configure rule sets for credit, interest slabs, and journeys without developers.[2]

This configurability supports rapid experimentation, such as A/B testing digital vs. assisted onboarding. No-code also lowers costs by reusing components like document upload and e-mandate, reducing total ownership expenses.[2]

In 2026, trends predict no-code AML adoption extending beyond banks, driven by embedded finance and real-time processing.[1][6]

Real-World Examples of No-Code AML in Action

Hawk AI serves global fintechs with no-code configuration for workflows, achieving 70% false positive reductions. Its platform handles payment screening, customer screening, and fraud monitoring, allowing focus on high-priority alerts.[4]

Unit21 offers fintechs a no-code interface to build and edit fraud and AML rules tailored to specific risks and behaviors.[5]

Development agencies combine no-code tools like Bubble with AML integrations for onboarding flows and compliance systems, delivering products in weeks.[3] Lenders use no-code for end-to-end lending compliance, including AML screening and risk scoring.[2]

Banks vs. Fintechs: The Compliance Arms Race

Banks face challenges with rigid systems and IT dependencies, slowing adaptations to regulatory shifts. Fintechs bypass this via no-code, empowering business teams to manage compliance directly. This reduces operational risk and enables scalability for growing portfolios.[2]

| Aspect | Banks (Traditional) | Fintechs (No-Code) |

|---|---|---|

| Development Speed | Months, IT-heavy | Weeks, business-led |

| Cost | High, custom builds | Low, reusable components |

| Compliance Updates | Slow, code rewrites | Fast, visual rules |

| Scalability | Re-architecture needed | Cloud-native, seamless |

No-code levels the playing field, but fintechs’ speed gives them an edge in innovation.[1][6]

2026 Trends Shaping No-Code AML

By 2026, no-code will integrate with AI for dynamic decisioning and embedded finance. Juniper Research forecasts no-code AML expanding beyond banks, alongside virtual cards in payments.[6]

Composable infrastructure and API-first designs will underpin compliance, supporting real-time rails and agentic AI.[1] Regulatory focus on financial crimes will demand proactive tools, with no-code enabling quick adaptations.

Challenges and Considerations

While powerful, no-code isn’t universal. Complex risk models may still need hybrid approaches. Fintechs must ensure security and governance, focusing IT on integrations.[2][3]

Adoption requires cultural shifts, training business teams on rule engines. Yet, benefits in speed and cost outweigh hurdles for most.[4]

Conclusion

The no-code AML revolution positions fintechs to outmaneuver banks, delivering compliant, scalable solutions faster. As 2026 approaches, early adopters will redefine compliance efficiency and innovation.

References

- https://m2pfintech.com/blog/10-banking-and-fintech-trends-that-will-redefine-2026-and-beyond/

- https://grintechindia.com/why-lenders-are-moving-toward-no-code-loan-platforms-in-2026/

- https://www.lowcode.agency/blog/best-fintech-development-agencies

- https://hawk.ai/industries/fintech

- https://www.unit21.ai/markets/fintech

- https://www.juniperresearch.com/press/juniper-research-unveils-the-top-10-trends-set-to-shape-fintech-payments-in-2026/