The 10-year Treasury yield has climbed back above 4% in early December 2025, marking a critical inflection point for investors watching the bond market closely. As of December 2, 2025, the yield on U.S. Treasury Securities at 10-Year Constant Maturity stood at 4.09%, while the 30-year bond yield reached 4.74%[1]. This move signals renewed pressure on fixed-income investments and raises important questions about where the Federal Reserve is headed next—and what that means for your portfolio.

For investors accustomed to the lower-yield environment of recent years, this threshold represents more than just a number. It reflects underlying economic dynamics, inflation expectations, and the Fed’s policy trajectory. Understanding these forces is essential for making informed investment decisions in the months ahead.

The Current Treasury Landscape

Treasury yields have been on an upward trajectory as 2025 progresses. The 10-year yield’s movement back to 4.09% represents a meaningful shift from earlier in the year, and the broader yield curve tells an interesting story about market expectations.

Looking across the maturity spectrum, shorter-term yields remain relatively contained. The 2-year Treasury yield sits at 3.51%, while the 3-month bill yields 3.72%[2]. This compression between short and long-term rates reflects uncertainty about the Fed’s future path. When longer-term yields rise faster than shorter-term yields, it typically signals that markets expect either sustained economic strength or persistent inflation concerns—or both.

The 30-year bond market deserves particular attention. At 4.74%, the long-end of the curve has climbed significantly, suggesting that investors pricing in a higher-for-longer interest rate environment. Historically, the 30-year bond yield reached an all-time high of 15.21% in October 1981 during the Volcker era of aggressive rate hikes[2]. Today’s 4.74% is nowhere near those extremes, but it does represent meaningful compensation for long-term lending to the U.S. government.

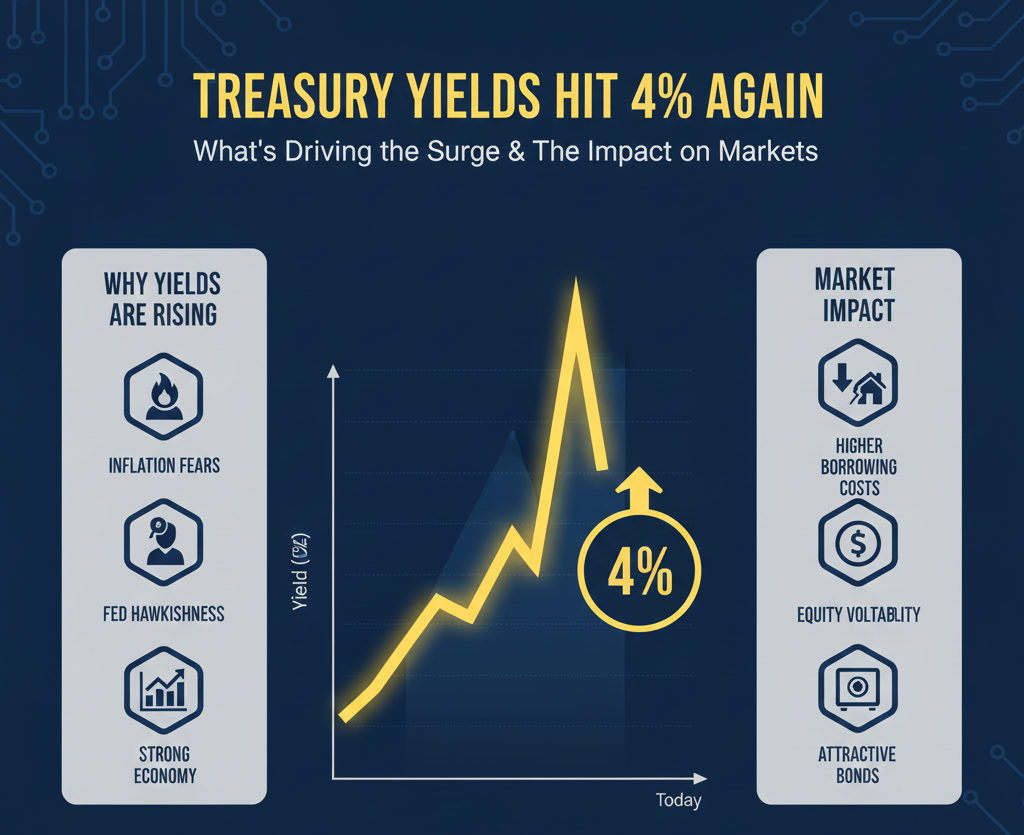

What’s Driving Yields Higher?

Several factors are pushing Treasury yields upward in December 2025. Understanding these drivers helps explain why the market is pricing in the current yield environment and what it might mean for future Fed policy.

Inflation Expectations: Despite efforts to bring inflation back to target, sticky price pressures remain a concern for policymakers and investors alike. When inflation expectations rise, bond investors demand higher yields to compensate for the erosion of purchasing power over time. The fact that 30-year yields are 0.40 percentage points higher than a year ago suggests persistent inflation concerns[2].

Economic Resilience: The U.S. economy has proven more resilient than many predicted. Strong labor markets, consumer spending, and corporate earnings have all supported growth expectations. When growth prospects improve, investors rotate away from the safety of Treasuries, pushing yields higher as prices fall.

Fiscal Dynamics: Government spending and debt issuance also influence Treasury yields. Increased supply of Treasury securities can push yields higher as the market absorbs new debt. Additionally, expectations about future fiscal policy can shape long-term rate expectations.

Global Factors: International interest rates and capital flows also play a role. If global yields rise or foreign investors reduce Treasury holdings, domestic yields must rise to attract buyers.

The Fed’s Policy Conundrum

The Federal Reserve faces a delicate balancing act. With Treasury yields rising and inflation remaining above target in many measures, the Fed must decide whether to maintain its current policy stance, continue cutting rates, or pause further reductions.

The current yield environment suggests markets are pricing in a relatively restrictive monetary policy for the foreseeable future. When the Fed holds rates steady or signals patience on further cuts, longer-term yields often rise as investors price in extended periods of tight policy. This creates a self-reinforcing dynamic where higher yields themselves can slow economic activity by raising borrowing costs for businesses and consumers.

The Fed’s next move will likely depend on incoming economic data. If inflation continues to decline and the labor market softens, the Fed may resume cutting rates, which could eventually push Treasury yields lower. Conversely, if inflation proves stickier than expected or growth remains robust, the Fed may maintain its current stance or even signal fewer future cuts than previously expected.

Portfolio Implications: Bonds, Stocks, and Beyond

Rising Treasury yields create both challenges and opportunities for investors across multiple asset classes.

Bond Investors: Higher yields are a double-edged sword. On one hand, new bond purchases now offer more attractive income. A 10-year Treasury at 4.09% provides meaningful yield for conservative investors. On the other hand, existing bondholders face mark-to-market losses as prices fall when yields rise. If you hold a bond portfolio, duration risk becomes increasingly important to monitor.

Stock Investors: Rising Treasury yields can pressure equity valuations, particularly for growth stocks. When risk-free rates rise, the discount rate applied to future corporate earnings increases, which can reduce the present value of those earnings. Technology and other high-growth sectors are especially sensitive to rate changes. However, if rising yields reflect genuine economic strength rather than Fed tightening, stocks may continue to perform well.

Real Estate and REITs: Higher yields make Treasury securities more competitive with real estate investments. Rising mortgage rates, driven by higher Treasury yields, can also reduce real estate demand and valuations. REIT investors should pay close attention to the trajectory of long-term rates.

Floating-Rate Instruments: Bank loans, floating-rate bonds, and other variable-rate securities can benefit from a higher-rate environment. These instruments reset periodically, allowing investors to capture higher yields as rates rise.

Strategic Positioning for the Next Phase

With Treasury yields back at 4%, investors should consider several strategic adjustments:

Reassess Duration: If you hold longer-duration bonds, consider whether the current yield compensates you for interest rate risk. The spread between 2-year and 10-year yields suggests some investors are being adequately compensated for duration risk, but this varies by individual circumstances.

Diversify Across Maturities: Rather than concentrating in one maturity, consider a ladder of Treasury securities across different maturities. This approach provides flexibility and reduces timing risk.

Monitor Credit Spreads: Corporate bond spreads relative to Treasuries will be crucial. If spreads widen significantly, it may signal growing economic concerns. If they remain stable, it suggests confidence in corporate creditworthiness despite higher rates.

Consider Inflation-Protected Securities: Treasury Inflation-Protected Securities (TIPS) can provide a hedge against inflation. The 30-year TIPS yield of 2.53% suggests markets expect moderate long-term inflation[2].

Looking Ahead: What to Watch

Several key indicators will shape Treasury yields and Fed policy in the coming months. Inflation data, employment reports, and Fed communications will all influence market expectations. Additionally, any shifts in fiscal policy or international economic conditions could impact yields.

The consensus view among market participants is that yields may face headwinds in the near term but could moderate if economic growth slows. Trading Economics models suggest the 30-year yield could trade at 4.64% by year-end 2025 and decline to 4.42% within 12 months[2], though such forecasts carry significant uncertainty.

Conclusion

Treasury yields hitting 4% again marks a meaningful moment for portfolio construction and risk management. The current environment reflects genuine economic dynamics—inflation concerns, growth resilience, and Fed policy uncertainty—rather than temporary market noise. Investors should use this opportunity to reassess their asset allocation, duration exposure, and overall portfolio positioning.

Rather than viewing rising yields as purely negative, consider them a reset button for fixed-income investing. The higher yields available today offer genuine income opportunities for patient, long-term investors. Simultaneously, equity investors should remain vigilant about valuation compression and consider rotating toward more defensive sectors if rate expectations continue to shift.

The Fed’s next move will ultimately depend on economic data and inflation trends. By staying informed about Treasury market dynamics and maintaining a diversified, well-thought-out portfolio strategy, you can navigate this evolving interest rate environment with confidence.

References

- https://fred.stlouisfed.org/series/DGS10

- https://tradingeconomics.com/united-states/30-year-bond-yield

- https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve

- https://www.federalreserve.gov/releases/h15/

- https://ycharts.com/indicators/10_year_treasury_rate

- https://www.savingsbond.gov/GA-FI/FedInvest/todaySecurityPriceDetail