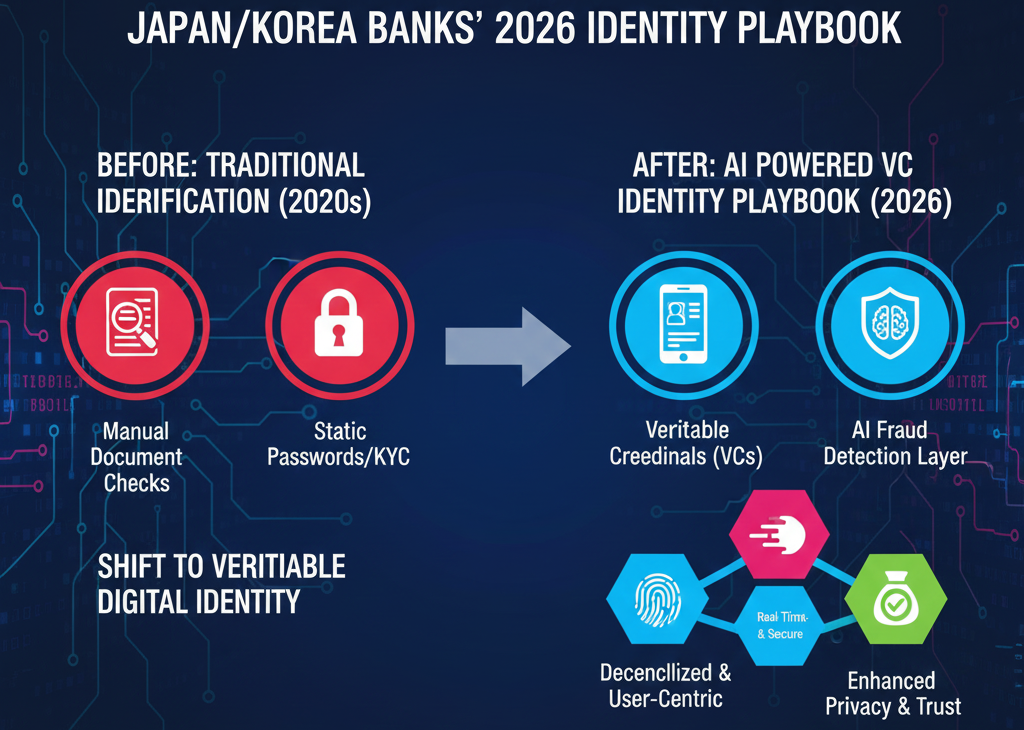

As artificial intelligence continues to evolve, so do the threats it poses to financial institutions. Identity fraud powered by AI has become increasingly sophisticated, leaving traditional authentication methods vulnerable. In response, banks across Asia-Pacific—particularly in Japan and South Korea—are embracing a transformative approach: verifiable credentials (VCs) and phishing-resistant authentication technologies. This strategic shift represents a fundamental reimagining of how financial institutions verify identity in an era of digital transformation.

The Rising Tide of AI-Driven Identity Fraud

Financial institutions face unprecedented challenges from AI-powered fraud. Traditional password-based systems and even standard two-factor authentication are no longer sufficient barriers against sophisticated attackers. The problem is acute in Japan, where Sumitomo Mitsui Trust Bank (SuMiTB) has experienced losses of hundreds of millions of yen from phishing-related fraud and account takeover attacks[1]. These incidents underscore a critical vulnerability: conventional authentication methods cannot reliably distinguish between legitimate users and attackers employing deepfakes, credential stuffing, and social engineering enhanced by machine learning.

Verifiable credentials offer a cryptographically secure alternative that ties identity verification directly to biometric data and decentralized identity frameworks[2]. Unlike traditional credentials that can be replicated or stolen, verifiable credentials are digitally signed and tamper-evident, making them exponentially harder to forge or manipulate.

Japan’s Strategic Regulatory Push

Japan’s regulatory environment is driving rapid adoption of advanced authentication methods. The Financial Services Agency (FSA) has proposed requiring financial institutions to implement phishing-resistant authentication methods, creating a compliance imperative that extends beyond voluntary adoption[1]. This regulatory pressure is catalyzing real-world deployment at scale.

In September 2025, TOPPAN Edge Inc. became Japan’s first Qualified vLEI Issuer (QVI) certified by the Global Legal Entity Identifier Foundation (GLEIF)[3]. This milestone signals Japan’s commitment to verifiable credentials infrastructure. TOPPAN Edge launched vLEI-Gateway™ in November 2025, which provides vLEI-based signature verification, screening, issuance, and renewal services[3]. The service supports three types of vLEI credentials: LE-vLEI (verifying entire legal entities), OOR-vLEI (verifying authorized representatives), and ECR-vLEI (verifying employees in functional roles)[3].

Beyond corporate identity, Japan’s government has accelerated digital credential deployment. Starting June 24, 2025, the government began issuing digital National IDs in mdoc format for iPhone users, with Android support planned for 2026[4]. These digital credentials include identity information such as name, birthdate, address, gender, and individual number (My Number), enabling both in-person and remote identity verification use cases[4].

South Korea’s Leadership in Digital Identity Standards

South Korea has emerged as a regional leader in digital identity infrastructure. The country leverages digital IDs for e-governance while incorporating FIDO (Fast Identity Online) standards and ISO/IEC 29115 compliance[4]. This multi-layered approach ensures both security and interoperability across government and private sector applications.

The Bank of Korea’s recent addition as the 10th central bank member to the Linux Foundation’s Decentralized Trust initiative demonstrates institutional commitment to verifiable credentials and decentralized identity frameworks[5]. This participation positions South Korea at the forefront of developing global standards for digital identity verification.

FIDO Authentication: The Phishing-Resistant Foundation

FIDO (Fast Identity Online) authentication has become central to Asia-Pacific banks’ fraud prevention strategies. Unlike traditional password-based systems, FIDO uses public-key cryptography to create phishing-resistant authentication that cannot be compromised through credential interception or social engineering[1].

Sumitomo Mitsui Trust Bank’s selection of OneSpan’s cloud-based FIDO authentication product exemplifies this trend[1]. The deployment introduces enterprise-scale, phishing-resistant authentication to Japan’s mobile banking sector, directly addressing the regulatory requirements set by the FSA[1]. This move is particularly significant because it represents a shift from on-premises deployments to cloud-based solutions, enabling greater scalability and accessibility for customers.

Regional Interoperability: A Critical Success Factor

The effectiveness of verifiable credentials depends on interoperability across borders and institutions. Japan, South Korea, and Australia are actively collaborating to ensure their verifiable digital credential systems can work seamlessly together[4]. This coordination is essential for cross-border financial transactions, where a credential issued by one institution must be verifiable by another across different jurisdictions.

The Asia Pacific Digital Identity Consortium, launched in December 2024 and driven by Japan’s Digital Agency, represents a formal commitment to standardization and interoperability[4]. By aligning on technical standards and governance frameworks, participating nations can create a unified digital identity ecosystem that benefits both financial institutions and consumers.

Corporate Identity Verification: The vLEI Advantage

For international business transactions, verifiable legal entity identifiers (vLEI) solve a longstanding problem: how to reliably confirm that a company actually exists and who has authority to represent it. TOPPAN Edge’s vLEI-Gateway™ addresses this through automated verification based on NIST SP800-63A IAL2 digital identity guidelines[3].

The practical applications are substantial. A pilot conducted by the BRP Consortium Business Site Digital Certification Research and Development Working Group is exploring vLEI use cases in semiconductor supply chain management, where verifying the authenticity of organizations is critical for security and compliance[3]. As vLEI adoption expands, TOPPAN Edge plans to launch a SaaS-based system in fiscal 2026 to enable other businesses to become qualified vLEI issuers, democratizing access to this infrastructure[3].

Digital Currency Integration and Future Expansion

Japan’s digital currency initiatives further accelerate the adoption of verifiable credentials. JPYC, a Japanese stablecoin, has obtained regulatory approval as an “electronic payment instrument” under the Payment Services Act[6]. The platform aims to reach an issuance scale of 10 trillion yen within three years, with applications extending to cross-border payments and foreign exchange trading[6]. Verifiable credentials will be essential for authenticating parties in these transactions, particularly in decentralized finance (DeFi) applications where traditional intermediaries are absent.

Japan Post Bank is also moving toward blockchain-based digital yen issuance, with a launch planned by the end of fiscal year 2026[6]. These initiatives create a compelling use case for verifiable credentials: as digital currencies proliferate, the need for cryptographically secure identity verification becomes paramount.

The Competitive Advantage of Early Adoption

Banks that implement verifiable credentials and FIDO authentication in 2026 gain significant competitive advantages. They reduce fraud losses, achieve regulatory compliance ahead of formal mandates, and build customer trust through transparent, secure authentication. Institutions that delay face mounting pressure from regulators and competitive disadvantage as customers migrate to more secure platforms.

The convergence of regulatory requirements, technological maturity, and business incentives creates a compelling case for rapid adoption. Japan and South Korea are demonstrating that this transition is not merely feasible—it is increasingly essential for financial institutions operating in the digital economy.

Conclusion

The battle against AI-driven identity fraud will not be won through incremental improvements to legacy authentication systems. Instead, banks in Japan and South Korea are pioneering a fundamental shift toward verifiable credentials, FIDO authentication, and decentralized identity frameworks. Through regulatory mandates, institutional commitments, and collaborative standardization efforts, these nations are building an identity infrastructure resilient to emerging threats. As 2026 unfolds, their playbook will likely become the template for financial institutions worldwide seeking to protect customers and assets in an age of sophisticated digital fraud.

References

- https://www.biometricupdate.com/202512/fido-alliance-broadens-scope-with-new-digital-credentials-work-deployments

- https://www.bankinfosecurity.com/verifiable-credentials-counter-ai-driven-identity-fraud-a-30318

- https://www.holdings.toppan.com/en/news/2025/09/newsrelease250911_1.html

- https://fidoalliance.org/passkeys-and-verifiable-digital-credentials-a-harmonized-path-to-secure-digital-identity/

- https://www.linuxfoundation.org/press/lf-decentralized-trust-adds-the-bank-of-korea-as-10th-central-bank-member-announces-paladin-a-new-programmable-privacy-framework-as-latest-project-1

- https://www.mexc.co/en-IN/news/83090