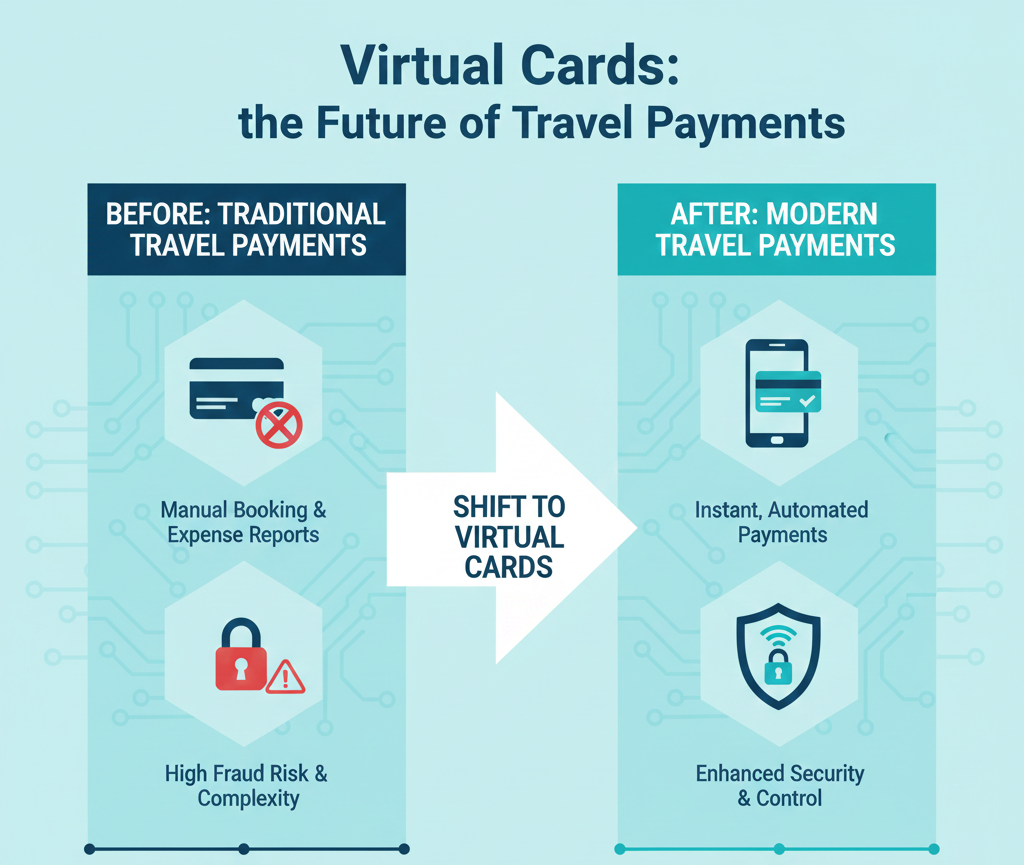

The way we pay for business travel is undergoing a seismic shift. While most travelers still swipe physical cards or submit expense reports for reimbursement, a quiet revolution is unfolding behind the scenes: virtual cards are rapidly becoming the backbone of modern travel management. What was once a niche fintech innovation is now poised to reshape how companies handle payments, reconciliation, and supplier relationships across the globe.

The numbers tell a compelling story. Corporate virtual card adoption is expected to triple by 2030[1], signaling a fundamental transformation in how businesses approach travel spending. Yet despite this explosive growth trajectory, many organizations remain uncertain about what virtual cards are, why they matter, and how to implement them effectively. This article explores the mechanics, benefits, and real-world implications of this payment revolution.

What Are Virtual Cards, and Why Do They Matter?

Virtual cards are digitally generated card numbers that exist only in software systems, not as physical plastic. Unlike traditional corporate cards tied to individual employees, virtual cards can be created on-demand, assigned to specific suppliers or transactions, and configured with unique parameters—such as spending limits, merchant categories, or expiration dates.[1]

In the travel context, this means a company can generate a unique virtual card number for a hotel booking, another for an airline reservation, and yet another for ground transportation—all without issuing physical cards to every employee. This approach offers three critical advantages:

- Enhanced security: Each virtual card number is unique and time-limited, dramatically reducing fraud risk. If a number is compromised, it becomes useless after its designated transaction or expiration date.

- Automated reconciliation: Virtual cards integrate directly with accounting software and expense management systems, eliminating manual data entry and reducing administrative overhead.

- Complete visibility: Real-time transaction data provides unprecedented insight into spending patterns, supplier performance, and cash flow management.

The Scale of the Shift: B2B Payments Lead the Way

The broader virtual card market is expanding at an extraordinary pace. The global B2B virtual card payment market will reach $14.6 trillion by 2029, representing 83% of the total virtual cards market globally.[2] This represents a dramatic acceleration from 2025, when B2B payments comprised 76% of the $5.2 trillion market.[2]

What’s driving this acceleration? Businesses are increasingly prioritizing financial agility and security. Virtual cards provide the digital infrastructure that legacy payment systems simply cannot match. In high-value sectors like healthcare and travel—where inefficient legacy systems and cash flow constraints have historically dominated—virtual cards offer a pathway to modernization.

The travel industry, in particular, stands at an inflection point. While corporate cards remain the dominant payment method for managed travelers (45% adoption), virtual cards have emerged as a sophisticated alternative that addresses specific pain points in hotel payments, supplier management, and expense reconciliation.[3]

The Hotel Payment Challenge: Introducing Virtual Card Acceptance Ratings

One persistent challenge has hindered virtual card adoption in travel: hotels don’t all handle virtual card transactions equally. Some properties process them flawlessly; others experience technical failures, declined transactions, or require manual workarounds at the front desk.

Recognizing this friction point, BCD Travel and Conferma launched the industry’s first Virtual Card Acceptance (VCA) Rating in November 2025.[1] This system scores hotels on a one-to-ten scale based on their real-world track record of processing virtual cards. The VCA Rating integrates directly into BCD’s booking platforms, allowing travel arrangers and business travelers to filter search results by virtual card acceptance reliability.

The implications are significant. Travelers no longer face surprise payment failures at the front desk. Travel managers can benchmark suppliers based on objective performance data rather than anecdotal feedback. Hotels with API integrations (Conferma Connect Direct) naturally achieve higher scores, demonstrating the operational benefits of deeper automation.[1]

This innovation exemplifies a broader trend: as virtual card adoption accelerates, the industry is building transparency and standardization into the ecosystem. Payment acceptance is no longer a black box—it’s measurable, comparable, and actionable.

Multi-Currency Benefits and Global Uncertainty

Another powerful driver of virtual card growth is their multi-currency functionality. In an era of volatile trade conditions and shifting tariffs, international businesses are drawn to virtual cards’ real-time, cross-border capabilities. These features enable companies to reduce risk amid global economic uncertainty.[2]

For travel managers operating across multiple regions, this is transformative. A single virtual card platform can handle transactions in euros, pounds, yen, and dozens of other currencies without requiring separate banking relationships or manual currency conversions. This streamlines operations while reducing exposure to exchange rate volatility.

The Data Analytics Opportunity

Beyond security and convenience, virtual cards unlock a powerful asset: transaction-level data. By leveraging the rich data generated through virtual card transactions, businesses can optimize internal processes, identify spending patterns, and reduce costs.[2]

Imagine a travel manager analyzing spending data across thousands of hotel transactions. Virtual card data reveals which properties consistently deliver cost-effective stays, which charge unexpected fees, and which offer the best value for specific traveler profiles. This intelligence enables smarter supplier negotiations and more efficient travel programs.

Forward-thinking virtual card providers are beginning to integrate advanced analytics into their platforms. Some are even exploring value-added services such as carbon tracking calculators, positioning virtual cards not merely as payment tools but as comprehensive business intelligence platforms.[2]

Adoption Realities: The Nuanced Picture

While the growth trajectory is undeniable, adoption rates reveal important nuances. Among managed travelers, virtual card usage has actually declined to 26% in 2025, down from 36% in 2019.[3] Why? Companies are consolidating payments within integrated booking-expense systems, often choosing to route transactions through unified platforms rather than issuing multiple virtual card numbers.

This apparent contradiction—declining virtual card usage among managed travelers despite explosive overall market growth—reflects a maturation of the market. Rather than replacing all payment methods, virtual cards are becoming embedded within larger travel management ecosystems. The distinction between “virtual card adoption” and “virtual card integration” is increasingly important.

What Travel Managers Should Know

For organizations considering virtual card implementation, several best practices emerge from current market trends:

- Assess supplier readiness: Use tools like the VCA Rating to identify which properties reliably process virtual cards before rolling out a program.

- Integrate with expense systems: Virtual cards deliver maximum value when connected to accounting software and expense management platforms.

- Leverage data analytics: Establish processes to analyze transaction data and extract insights for cost optimization and supplier management.

- Plan for multi-currency: If your organization operates internationally, prioritize virtual card providers with robust multi-currency and cross-border capabilities.

- Communicate clearly: Ensure travelers understand how virtual cards work, what to expect at the point of sale, and how to handle exceptions.

The Broader Payments Landscape

Virtual cards don’t exist in isolation. They’re part of a larger transformation in how the world pays for goods and services. In 2026, we’re witnessing a historic milestone: for the first time, more than half of the world’s total consumer payments will be made with card credentials rather than cash.[4] This shift reflects decades of innovation in digital payments, from contactless cards to mobile wallets to tokenization.

Virtual cards represent the next frontier in this evolution—a technology that combines the security of digital payments with the flexibility and control that modern businesses demand.

Conclusion

Virtual cards are not a passing trend or a niche fintech experiment. They represent a fundamental reimagining of how organizations manage payments, control spending, and reconcile transactions. With corporate adoption expected to triple by 2030 and the B2B virtual card market reaching $14.6 trillion by 2029, the question is no longer whether virtual cards will reshape business travel—it’s how quickly organizations can adapt to this new reality.

For travel managers, procurement professionals, and finance leaders, the time to understand and evaluate virtual cards is now. The companies that move early will gain competitive advantages in cost control, operational efficiency, and traveler experience. Those that wait risk falling behind as the industry standard shifts beneath their feet. The hidden hack reshaping global payments isn’t hidden anymore—it’s becoming mainstream.

References

- https://www.gbta.org/bcd-travel-and-conferma-reveal-first-ever-hotel-virtual-card-acceptance-rating/

- https://www.juniperresearch.com/press/b2b-spending-to-dominate-global-virtual-cards-market/

- https://www.phocuswright.com/Travel-Research/Research-Updates/2026/Travel-Forward-Data-Insights-and-Trends-for-2026

- https://corporate.visa.com/en/sites/visa-perspectives/trends-insights/2026-predictions.html